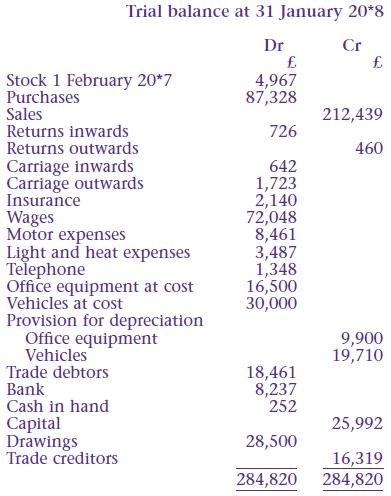

David Lycett provides the following information: Additional information at 31 January 20*8 Stock was valued at

Question:

David Lycett provides the following information:

Additional information at 31 January 20*8

■ Stock was valued at £5,141.

■ Wages owing £312.

■ Light and heat expenses paid in advance £248.

■ Depreciation on office equipment is calculated using the straight line method at 10% per annum.

■ Depreciation on vehicles is calculated using the reducing balance method at 30% per annum.

Required

a) Prepare a trading and profit and loss account for the year ended 31 January 20*8.

b) Prepare a balance sheet at 31 January 20*8.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: