Consider a two-step binomial model (left(S_{k} ight)_{k=0,1,2}) with interest rate (r=0 %) and risk-neutral probabilities (left(p^{*}, q^{*}

Question:

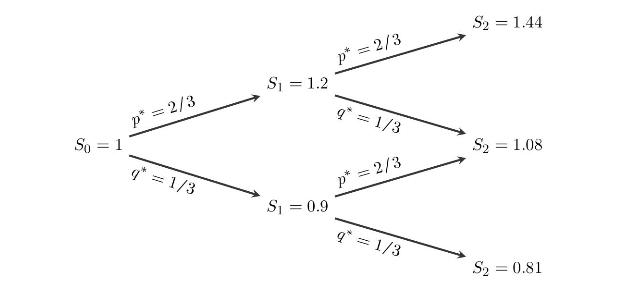

Consider a two-step binomial model \(\left(S_{k}\right)_{k=0,1,2}\) with interest rate \(r=0 \%\) and risk-neutral probabilities \(\left(p^{*}, q^{*}\right)\) :

a) At time \(t=1\), would you exercise the American put option with strike price \(K=1.25\) if \(S_{1}=1.2\) ? If \(S_{1}=0.9\) ?

b) What would be your investment allocation at time \(t=0\) ?

Transcribed Image Text:

p* = 2/3 S = 1.44 S = 1.2 p* = 2/3 So = 1 q* = 1/3 q* = 1/3 p* = 2/3 S = 1.08 S = 0.9 q* = 1/3 S = 0.81

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The option p...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault

Question Posted:

Students also viewed these Business questions

-

13. What is a lower bound for the price of 3-month call option on a non- dividend-paying stock when the stock price is $50, the strike price is $45, and the 3-month risk-free interest rate is 8%?...

-

A Network Administrator issued the command PING 127.0.0.1. Explain what she wanted to achieve.

-

E-max sold Dishwashers on credit, worth OMR 55,000 to customers, out of these Dishwashers customers return damaged Dishwashers for OMR 6,000. Record the entry for the Dishwashers returned? a. Debit...

-

In the special report, "Bitter Pill: Why Medical Bills Are Killing Us" (TIME, Vol. 181, No. 8, 2013), S. Brill presented an in-depth investigation of hospital billing practices that reveals why U.S....

-

You wish to calculate the risk level of your portfolio based on its beta. The five stocks in the portfolio with their respective weights and betas are shown in the accompanying table. Calculate the...

-

A Pepsi promotion encouraged consumers to collect Pepsi points and redeem them for merchandise. If they did not have quite enough points for the prize they wanted, they could buy additional points...

-

The Waygate Corporation makes five different types of metal casing for personal computers. The company is in the process of replacing its machinery with three different new models of metal stamping...

-

Explain the relationship and the difference between online analytical processing systems and customer relationship management systems within a business intelligence program.?

-

Consider an American butterfly option with the following payoff function. Price the perpetual American butterfly option with \(r>0\) in the following cases. a) \(\widehat{K} \leqslant L^{*} \leqslant...

-

The quality of sleep is measured by factors such as heart rate, blood pressure, REM cycle interval, etc. The file SleepQuality contains data about the sleep duration (in minutes) and sleep quality...

-

Give three examples of engineered products that must be transparent.

-

Section 1. Questions 1- What is capacity management and what does it consist of? 2- Give two real examples of revenue administration. Give an example of your answer. Section 2. Questions 1- Perform a...

-

Explain the difference between the predispositional and socialized theories of police behavior.

-

Database and spreadsheet (Excel) skills are highly sought after in the field. At first, these can seem very hard to understand and use; but, with practice, the basic skills can be quickly mastered....

-

The management of S Hotel in Montego Bay, St James is rejecting allegations of racism and unfair dismissal made by a former worker. Matthew Rodney, who was employed as a bartender, made the claims in...

-

The backbone of corrections is its workforce. The corrections sector relies on qualified, trained, and dedicated staff for effective, professional operations. But today, correctional administrators,...

-

A corporate bond has a face value of $l 000 with maturity date 20 years from today. The bond pays interest manually at a rate of 8% per year based on the face value. The interest rate paid on similar...

-

What is the expected payoff of an investment that yields $5,000 with a probability of 0.15 and $500 with a probability of 0.85? Select one: O a. $325 O b. $5,500 O c. $2,750 O d. $1,175

-

Are emotions universal? Why or why not? Give examples in your answer.

-

Describe the two most common methods of assessing a personality. Which is likely to be the most accurate? Why?

-

Describe the Myers-Briggs Type Indicator ( MBTI ) personality framework. Based on the framework, what would you think was your personality type? Why?

-

Jay da takes 2 hours to deliver 120 newspapers on her paper route. What is the rate per hour at which she delivers the newspapers?

-

The author of a book was told that he would have to cut the number of pages in his book by 17%. If the finished book contained 418 pages, how many pages were cut?

-

a,b,c and d are 4 integers written in order of size, starting with the smallest integer. The mean of a,b,c and d is 15 The sum of a,b and c is 39 (a) Find the value of d.

Study smarter with the SolutionInn App