Consider the Asian forward contract with payoff [begin{equation*}frac{1}{T} int_{0}^{T} S_{u} d u-K tag{13.36}end{equation*}] where (S_{u}=S_{0} mathrm{e}^{sigma B_{u}+r

Question:

Consider the Asian forward contract with payoff

\[\begin{equation*}\frac{1}{T} \int_{0}^{T} S_{u} d u-K \tag{13.36}\end{equation*}\]

where \(S_{u}=S_{0} \mathrm{e}^{\sigma B_{u}+r u-\sigma^{2} u / 2}, u \geqslant 0\), and \(\left(B_{u}ight)_{u \in \mathbb{R}_{+}}\)is a standard Brownian motion under the risk-neutral measure \(\mathbb{P}^{*}\).

a) Price the long forward Asian contract at any time \(t \in[0, T]\).

b) Derive a call-put parity relation between the prices \[C(t, K):=\mathrm{e}^{-(T-t) r} \mathbb{E}^{*}\left[\left.\left(\frac{1}{T} \int_{0}^{T} S_{u} d u-Kight)^{+} ightvert\, \mathcal{F}_{t}ight]\]and \[P(t, K):=\mathrm{e}^{-(T-t) r} \mathbb{E}^{*}\left[\left.\left(K-\frac{1}{T} \int_{0}^{T} S_{u} d uight)^{+} ightvert\, \mathcal{F}_{t}ight]\]of Asian call and put options.

c) Find the self-financing portfolio strategy \(\left(\xi_{t}ight)_{t \in[0, T]}\) hedging the Asian forward contract with payoff (13.36), where \(\xi_{t}\) denotes the quantity invested at time \(t \in[0, T]\) in the risky asset \(S_{t}\).

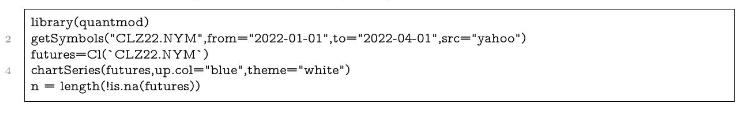

d) Compute the numerical value of the price \[\mathrm{e}^{-(T-t) r}\mathbb{E}^{*}\left[\left.\frac{1}{T} \int_{0}^{T} S_{u} d u-K ightvert\,\mathcal{F}_{t}ight]\]of the long forward Asian contract on Light Sweet Crude Oil Futures (CLZ22.NYM) using the following market data:

Issue date: 2022-01-01, Maturity \(T=2022-12-31\), Strike price \(K=\$ 80\), Interest rate \(r=2 \%\) per year, \(t=2022-04-01\), Number of business days per month: 21, per year: 252 .

Step by Step Answer:

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault