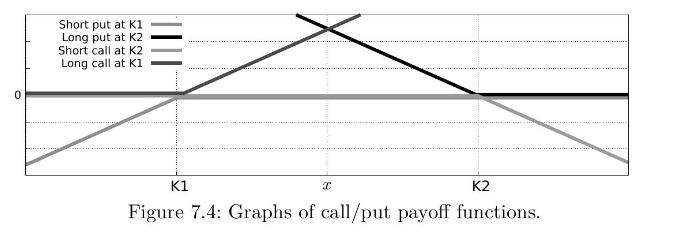

Given two strike prices (K_{1} - One long call with strike price (K_{1}) and payoff function (left(x-K_{1}ight)^{+}),

Question:

Given two strike prices \(K_{1}

- One short put with strike price \(K_{1}\) and payoff function \(-\left(K_{1}-xight)^{+}\),

- One short call with strike price \(K_{2}\) and payoff function \(-\left(x-K_{2}ight)^{+}\),

- One long put with strike price \(K_{2}\) and payoff function \(\left(K_{2}-xight)^{+}\).

The risk-free interest rate is denoted by \(r \geqslant 0\).

a) Find the payoff of the long box spread option in terms of \(K_{1}\) and \(K_{2}\).

b) Price the long box spread option at times \(k=0,1, \ldots, N\) using \(K_{1}, K_{2}\) and the interest rate \(r\).

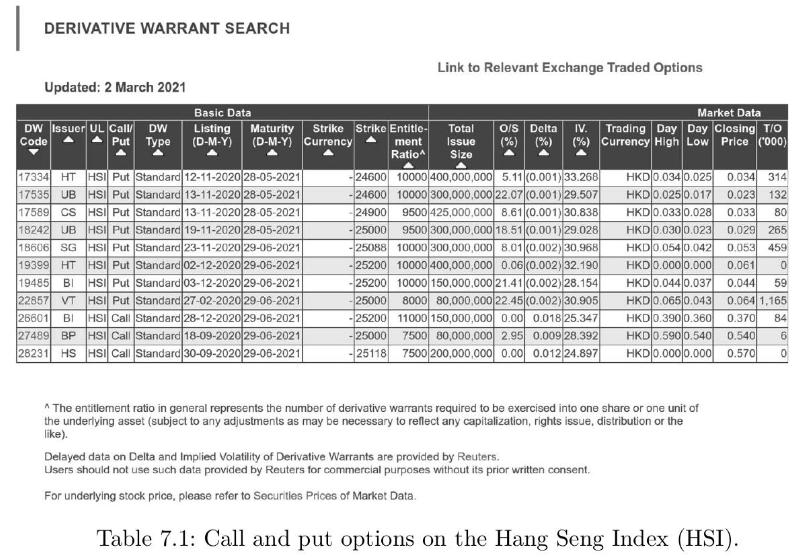

c) From Table 7.1 below, find a choice of strike prices \(K_{1}

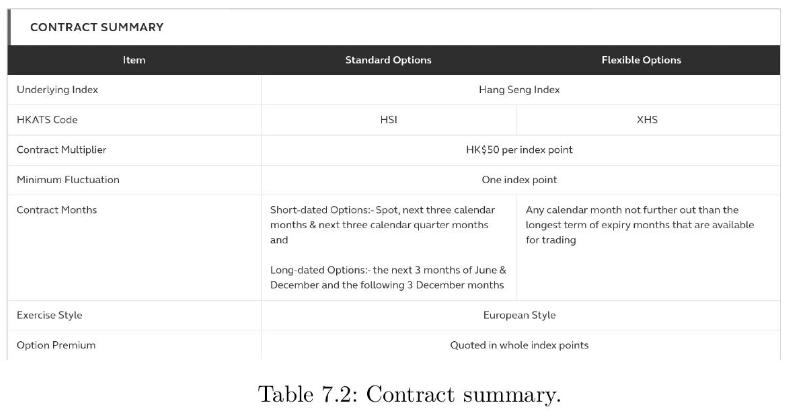

d) Price the option built in part (c) in index points, and then in \(\mathrm{HK} \$\).

Hints.

i) The closing prices in Table 7.1 are warrant prices quoted in index points.

ii) Warrant prices are converted to option prices by multiplication by the number given in the "Entitlement Ratio" column.

iii) The conversion from index points to \(\mathrm{HK} \$\) is given in Table 7.2.

e) Would you buy the option priced in part (d) ? Here we can take \(r=0\) for simplicity.

Step by Step Answer:

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault