The Capital Asset Pricing Model (CAPM) of W.F. Sharpe (1990 Nobel Prize in Economics) is based on

Question:

The Capital Asset Pricing Model (CAPM) of W.F. Sharpe (1990 Nobel Prize in Economics) is based on a linear decomposition

\[

\frac{d S_{t}}{S_{t}}=(r+\alpha) d t+\beta \times\left(\frac{d M_{t}}{M_{t}}-r d tight)

\]

of stock returns \(d S_{t} / S_{t}\) into:

- a risk-free interest rate \(^{\frac{\ddagger}{+}} r\),

- an excess return \(\alpha\),

- a risk premium given by the difference between a benchmark market index return \(d M_{t} / M_{t}\) and the risk free rate \(r\).

The coefficient \(\beta\) measures the sensitivity of the stock return \(d S_{t} / S_{t}\) with respect to the market index returns \(d M_{t} / M_{t}\). In other words, \(\beta\) is the relative volatility of \(d S_{t} / S_{t}\) with respect to \(d M_{t} / M_{t}\), and it measures the risk of \(\left(S_{t}ight)_{t \in \mathbb{R}_{+}}\)in comparison to the market index \(\left(M_{t}ight)_{t \in \mathbb{R}_{+}}\).

If \(\beta>1\), resp. \(\beta

Vanguard 500 Index Fund (VFINX) has a \(\beta=1\) and can be considered as replicating the variations of the S\&P 500 index \(M_{t}\), while Invesco \(S \mathcal{E} P 500\) (SPHB) has a \(\beta=1.42\), and Xtrackers Low Beta High Yield Bond ETF (HYDW) has a \(\beta\) close to 0.36 and \(\alpha=6.36\).

In what follows, we assume that the benchmark market is represented by an index fund \(\left(M_{t}ight)_{t \in \mathbb{R}_{+}}\)whose value is modeled according to

\[

\begin{equation*}

\frac{d M_{t}}{M_{t}}=\mu d t+\sigma_{M} d B_{t} \tag{7.51}

\end{equation*}

\]

where \(\left(B_{t}ight)_{t \in \mathbb{R}_{+}}\)is a standard Brownian motion. The asset price \(\left(S_{t}ight)_{t \in \mathbb{R}_{+}}\)is modeled in a stochastic version of the CAPM as

\[

\begin{equation*}

\frac{d S_{t}}{S_{t}}=r d t+\alpha d t+\beta\left(\frac{d M_{t}}{M_{t}}-r d tight)+\sigma_{S} d W_{t} \tag{7.52}

\end{equation*}

\]

with an additional stock volatility term \(\sigma_{S} d W_{t}\), where \(\left(W_{t}ight)_{t \in \mathbb{R}_{+}}\)is a standard Brownian motion independent of \(\left(B_{t}ight)_{t \in \mathbb{R}_{+}}\), with

\[

\operatorname{Cov}\left(B_{t}, W_{t}ight)=0 \quad \text { and } \quad d B_{t} \cdot d W_{t}=0, \quad t \geqslant 0 .

\]

The following 10 questions are interdependent and should be treated in sequence.

a) Show that \(\beta\) coincides with the regression coefficient

\[

\beta=\frac{\operatorname{Cov}\left(d S_{t} / S_{t}, d M_{t} / M_{t}ight)}{\operatorname{Var}\left[d M_{t} / M_{t}ight]}

\]

Hint: We have

\[

\operatorname{Cov}\left(d W_{t}, d W_{t}ight)=d t, \quad \operatorname{Cov}\left(d B_{t}, d B_{t}ight)=d t, \quad \text { and } \quad \operatorname{Cov}\left(d W_{t}, d B_{t}ight)=0

\]

b) Show that the evolution of \(\left(S_{t}ight)_{t \in \mathbb{R}_{+}}\)can be written as

\[

d S_{t}=(r+\alpha+\beta(\mu-r)) S_{t} d t+S_{t} \sqrt{\beta^{2} \sigma_{M}^{2}+\sigma_{S}^{2}} d Z_{t}

\]

where \(\left(Z_{t}ight)_{t \in \mathbb{R}_{+}}\)is a standard Brownian motion.

Hint: The standard Brownian motion \(\left(Z_{t}ight)_{t \in \mathbb{R}_{+}}\)can be characterized as the only continuous (local) martingale such that \(\left(d Z_{t}ight)^{2}=d t\), see e.g. Theorem 7.36 page 203 of Klebaner (2005).

From now on, we assume that \(\beta\) is allowed to depend locally on the state of the benchmark market index \(M_{t}\), as \(\beta\left(M_{t}ight), t \geqslant 0\).

c) Rewrite the equations (7.51)-(7.52) into the system

\[

\left\{\begin{array}{l}

\frac{d M_{t}}{M_{t}}=r d t+\sigma_{M} d B_{t}^{*} \\

\frac{d S_{t}}{S_{t}}=r d t+\sigma_{M} \beta\left(M_{t}ight) d B_{t}^{*}+\sigma_{S} d W_{t}^{*}

\end{array}ight.

\]

where \(\left(B_{t}^{*}ight)_{t \in \mathbb{R}_{+}}\)and \(\left(W_{t}^{*}ight)_{t \in \mathbb{R}_{+}}\)have to be determined explicitly.

d) Using the Girsanov Theorem 7.3, construct a probability measure \(\mathbb{P}^{*}\) under which \(\left(B_{t}^{*}ight)_{t \in \mathbb{R}_{+}}\)and \(\left(W_{t}^{*}ight)_{t \in \mathbb{R}_{+}}\)are independent standard Brownian motions.

Hint: Only the expression of the Radon-Nikodym density \(\mathrm{dP} \mathbb{P}^{*} / \mathrm{dP}\) is needed here.

e) Show that the market based on the assets \(S_{t}\) and \(M_{t}\) is without arbitrage opportunities.

f) Consider a portfolio strategy \(\left(\xi_{t}, \zeta_{t}, \eta_{t}ight)_{t \in[0, T]}\) based on the three assets \(\left(S_{t}, M_{t}, A_{t}ight)_{t \in[0, T]}\), with value

\[

V_{t}=\xi_{t} S_{t}+\zeta_{t} M_{t}+\eta_{t} A_{t}, \quad t \in[0, T]

\]

where \(\left(A_{t}ight)_{t \in \mathbb{R}_{+}}\)is a riskless asset given by \(A_{t}=A_{0} \mathrm{e}^{r t}\). Write down the self-financing condition for the portfolio strategy \(\left(\xi_{t}, \zeta_{t}, \eta_{t}ight)_{t \in[0, T]}\).

g) Consider an option with payoff \(C=h\left(S_{T}, M_{T}ight)\), priced as

\[

f\left(t, S_{t}, M_{t}ight)=\mathrm{e}^{-(T-t) r} \mathbb{E}^{*}\left[h\left(S_{T}, M_{T}ight) \mid \mathcal{F}_{t}ight], \quad 0 \leqslant t \leqslant T .

\]

Assuming that the portfolio \(\left(V_{t}ight)_{t \in[0, T]}\) replicates the option price process \(\left(f\left(t, S_{t}, M_{t}ight)ight)_{t \in[0, T]}\), derive the pricing PDE satisfied by the function \(f(t, x, y)\) and its terminal condition.

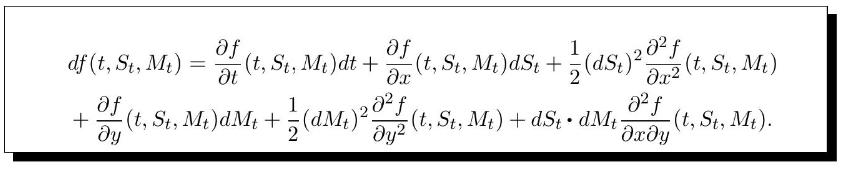

Hint: The following version of the Itô formula with two variables can be used for the function \(f(t, x, y)\), see \((4.26)\) :

h) Find the self-financing hedging portfolio strategy \(\left(\xi_{t}, \zeta_{t}, \eta_{t}ight)_{t \in[0, T]}\) replicating the vanilla payoff \(h\left(S_{T}, M_{T}ight)\).

i) Solve the PDE of Question (g) and compute the replicating portfolio of Question (h) when \(\beta\left(M_{t}ight)=\beta\) is a constant and \(C\) is the European call option payoff on \(S_{T}\) with strike price \(K\).

j) Solve the PDE of Question (g) and compute the replicating portfolio of Question (h) when \(\beta\left(M_{t}ight)=\beta\) is a constant and \(C\) is the European put option payoff on \(S_{T}\) with strike price \(K\).

Step by Step Answer:

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault