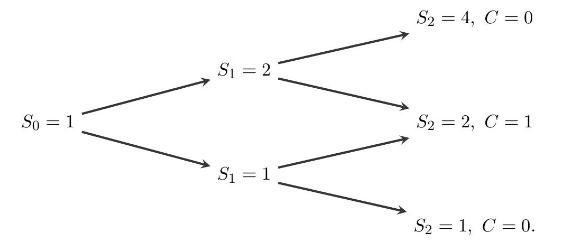

We consider a two-step binomial market model (left(S_{t}ight)_{t=0,1,2}) with (S_{0}=1) and return rates (R_{t}=left(S_{t}-S_{t-1}ight) / S_{t-1}, t=1,2),

Question:

We consider a two-step binomial market model \(\left(S_{t}ight)_{t=0,1,2}\) with \(S_{0}=1\) and return rates \(R_{t}=\left(S_{t}-S_{t-1}ight) / S_{t-1}, t=1,2\), taking the values \(a=0, b=1\), and assume that

\[ p:=\mathbb{P}\left(R_{t}=1ight)>0, \quad q:=\mathbb{P}\left(R_{t}=0ight)>0, \quad t=1,2 \]

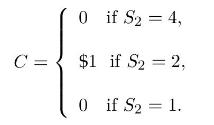

The riskless account is \(A_{t}=\$ 1\) and the risk-free interest rate is \(r=0\). We consider the tunnel option whose payoff \(C\) at time \(t=2\) is given by

a) Build a hedging portfolio for the claim \(C\) at time \(t=1\) depending on the value of \(S_{1}\).

b) Price the claim \(C\) at time \(t=1\) depending on the value of \(S_{1}\).

c) Build a hedging portfolio for the claim \(C\) at time \(t=0\).

d) Price the claim \(C\) at time \(t=0\).

e) Does this model admit an equivalent risk-neutral measure in the sense of Definitions \(2.12-2.14\) ?

f) Is the model without arbitrage according to Theorem 2.15?

Step by Step Answer:

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault