Pfizer is one of the largest pharmaceutical companies in the world and has a patent on a

Question:

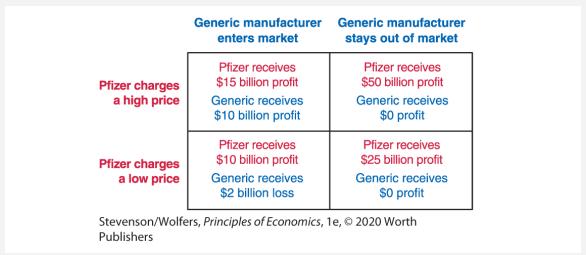

Pfizer is one of the largest pharmaceutical companies in the world and has a patent on a drug that treats heartburn. If the patent is about to expire, then Pfizer has two options: It can continue to charge a high price for its product or charge a low price. After the patent expires, a drug company that produces generic drugs must decide whether to enter the market or not enter the market. The associated payoff table is as follows:

a. If Pfizer and the generic manufacturer were making these decisions simultaneously, what would the Nash equilibrium be? Briefly explain how you found your answer.

b. If Pfizer is able to allow the generic manufacturer to make a decision first and then responds to that decision with its pricing strategy, relative to the simultaneous play game, would Pfizer gain a second-mover advantage by waiting? Briefly explain your reasoning.

c. If Pfizer is able to select its pricing strategy first and allowed the generic manufacturer to respond to its decision, relative to the simultaneous-play game, would Pfizer gain a first-mover advantage by moving aggressively? Briefly explain your reasoning.

d. In a sequential-play game, would Pfizer be willing to pay the generic manufacturer to guarantee that it would not enter the market? If so, what is the most that Pfizer would be willing to pay?

Step by Step Answer: