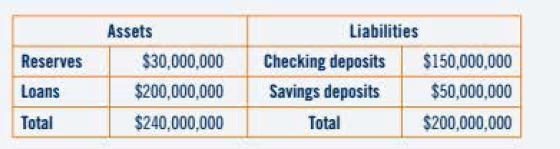

Consider the above balance sheet of a bank. a. If the required reserve ratio on checking deposits

Question:

Consider the above balance sheet of a bank.

a. If the required reserve ratio on checking deposits is 0.10, how much must the bank maintain in required reserves?

b. How much money in excess reserves does the bank have?

c. What is the total amount of money this bank could currently loan out?

d. What is the value of the money multiplier?

e. What is the maximum amount by which the money supply could increase if this bank lends out all its excess reserves?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Economics Social Issues And Economic Thinking

ISBN: 9780470574782

1st Edition

Authors: Wendy A. Stock

Question Posted: