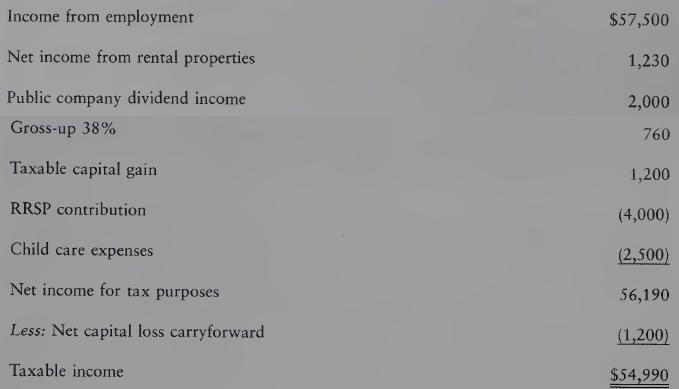

Joshuas computation of taxable income for 2016 is as follows: NOTES: (a) Assume Joshua was resident in

Question:

Joshua’s computation of taxable income for 2016 is as follows:

NOTES:

(a) Assume Joshua was resident in Canada on December 31, 2016.

(b) Assume that Joshua’s taxable income was prepared correctly.

(c) Joshua is divorced and lives with his 7-year-old son, Jamie.

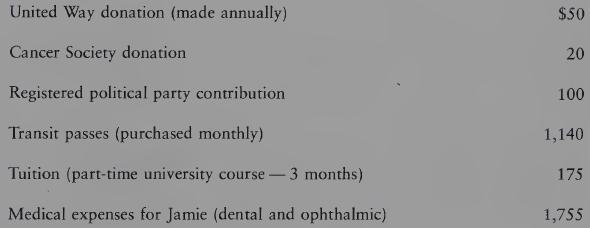

(d) During the year Joshua incurred the following expenses:

(e) T4 information:

REQUIRED

Compute Joshua's federal and provincial taxes payable. Assume the provincial tax rates are as set out in ¶10,250. Also assume that the provincial tax credit base amounts are the same as the federal amounts; there are no over/under payments of EI and CPP

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: