Larry Hewitt provides you with the following income (losses) for tax purposes for the years 2014 to

Question:

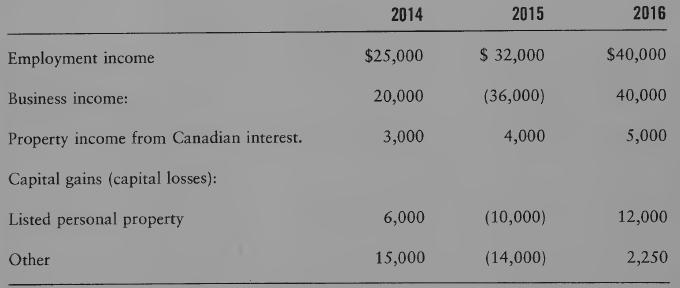

Larry Hewitt provides you with the following income (losses) for tax purposes for the years 2014 to 2016:

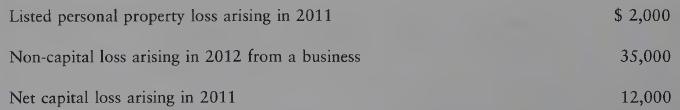

Larry also provides the following additional information: (1) Loss carryovers:

Larry also provides the following additional information: (1) Loss carryovers:

(2) Larry did not claim a capital gains deduction or net capital losses in the years prior to 2014.

REQUIRED

Dealing with each item line-by-line across the years, rather than one year at a time;

(1) Determine Larry’s income for 2014 to 2016 according to the ordering rules in section 3, and

(2) Determine Larry’s taxable income for 2014 to 2016 according to the ordering rule in Division C after amending the returns.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: