Hawthorn and Privet have carried on business in partnership for a number of years, sharing profits in

Question:

Hawthorn and Privet have carried on business in partnership for a number of years, sharing profits in the ratio of 4 : 3 after charging interest on capital at 4 per cent per annum. Holly was admitted into the partnership on 1 October 20X8, and the terms of the partnership from then were agreed as follows:

1. Partners’ annual salaries to be: Hawthorn £1,800, Privet £1,200, Holly £1,100.

2. Interest on capital to be charged at 4 per cent per annum.

3. Profits to be shared: Hawthorn four-ninths, Privet three-ninths, Holly two-ninths.

On 1 October 20X8 Holly paid £7,000 into the partnership bank and of this amount £2,100 was in respect of the share of goodwill acquired by her. Since the partnership has never created, and does not intend to create, a goodwill account, the full amount of £7,000 was credited for the time being to Holly’s capital account at 1 October 20X8.

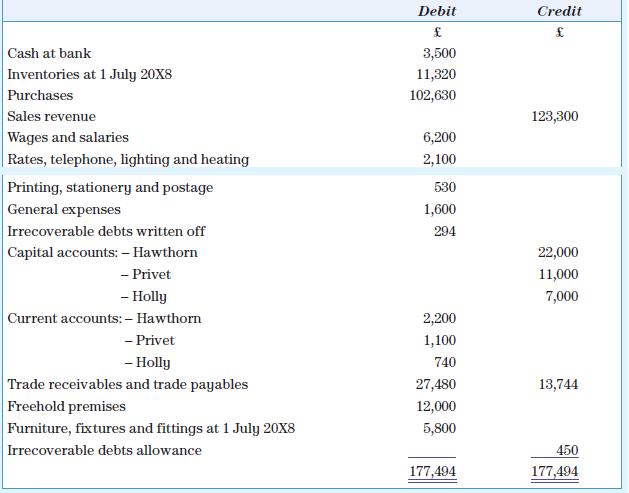

The trial balance of the partnership at 30 June 20X9 was as follows:

After taking into account the following information and the adjustment required for goodwill, prepare a statement of profit or loss for the year ended 30 June 20X9 and a statement of financial position as on that date. On 30 June 20X9:

1. Inventory was £15,000.

2. Rates (£110) and wages and salaries (£300) were outstanding.

3. Telephone rental paid in advance was £9.

4. Allowance for irrecoverable debts is to be adjusted to 2.5 per cent of trade receivables.

5. Depreciation is to be provided on furniture, fixtures and fittings at 10 per cent.

Apportionments required are to be made on a time basis.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas