Miss Fitt owns a retail shop. The statement of profit or loss and statement of financial position

Question:

Miss Fitt owns a retail shop. The statement of profit or loss and statement of financial position are prepared annually by you from records consisting of a bank statement and a file of unpaid suppliers and outstanding trade receivables.

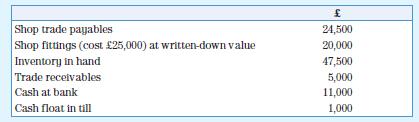

The following balances were shown on her statement of financial position at 1 January 20X9:

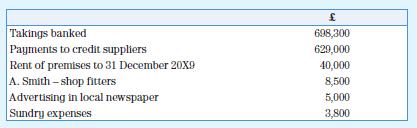

The following is a summary of her bank statement for the year ended 31 December 20X9:

You obtain the following additional information:

1. Takings are banked daily and all suppliers are paid by direct debit, but Miss Fitt keeps £1,500 per week for herself, and pays her assistant £1,100 per week out of the takings.

2. The work done by A. Smith was for new shelving and repairs to existing fittings. The cost of new shelves was estimated at £5,000.

3. The cash float in the till was considered insufficient and raised to £1,500.

4. Miss Fitt took £7,500 worth of goods for her own use without payment.

5. Your charges will be £2,500 for preparing the financial statements.

6. The outstanding accounts file shows £23,000 due to credit suppliers, £1,000 due in respect of sundry expenses, and £8,500 outstanding trade receivables.

7. Depreciation on shop fittings is provided at 10 per cent on cost, a full year’s charge being made in year of purchase.

8. Inventory in hand at 31 December 20X9 was £71,000.

You are required to prepare Miss Fitt’s statement of profit or loss for the year ended 31 December 20X9, and her statement of financial position as at that date.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas