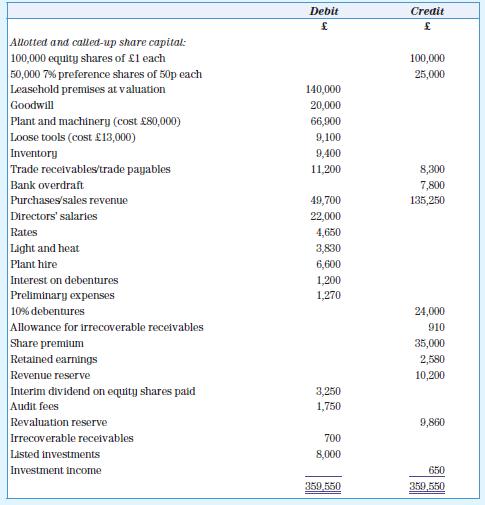

The following is the trial balance of D. Cooper Ltd as at 30 September 20X9: Additional information

Question:

The following is the trial balance of D. Cooper Ltd as at 30 September 20X9:

Additional information

1. Inventory at 30 September 20X9 is valued at £13,480.

2. Rates include a payment of £2,300 for the six months from 1 July 20X9.

3. Depreciation on plant is 15 per cent per annum of cost and the loose tools were valued at £7,800 on 30 September 20X9. Goodwill did not suffer any diminution in value. The company does not depreciate its premises.

4. The allowance for irrecoverable receivables is to be adjusted to 10 per cent of the trade receivables at the end of the year.

5. The preference share dividends are outstanding at the end of the year and the last half year’s interest on the debentures has not been paid.

6. The corporation tax on this year’s profit is £6,370.

7. The directors propose to declare a final dividend on the equity shares of 13 pence per share and transfer £2,500 to revenue reserves.

You are required to prepare in publishable form a statement of comprehensive income and a statement of changes in equity for the year ended 30 September 20X9, and a statement of financial position at that date.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas