X, Y and Z are in partnership sharing profits and losses in the ratio 4 : 2

Question:

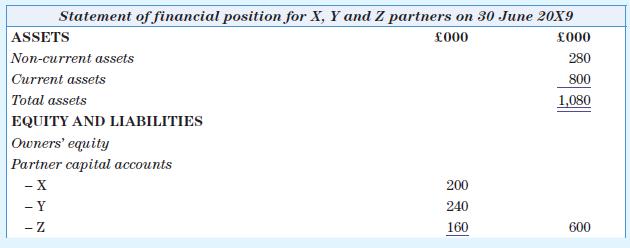

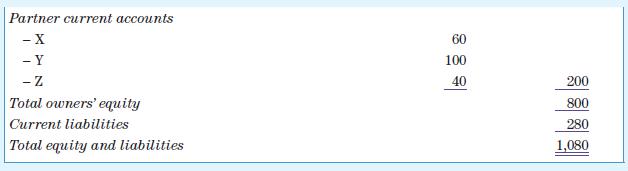

X, Y and Z are in partnership sharing profits and losses in the ratio 4 : 2 : 2. Z died on 30 June 20X9. The partnership statement of financial position as at that date was:

Additional information

It was agreed between X, Y and Z’s representatives that on 30 June 20X9 (for the purposes of settling the affairs of Z) goodwill be valued at £120,000 and the freehold land (the only on-current asset) at £360,000. The balance owing to Z will remain on loan to the partnership for five years at a rate of 10 per cent interest per annum. X and Y agree that goodwill should not be reflected as an asset in the financial statements; however, the new value of freehold land should. They also agree that in the future they will share profits and losses equally.

Required

a. Prepare the capital and current accounts for the three partners, the revaluation account and the opening statement of financial position for the new X and Y partnership.

b. Explain goodwill and outline why it is important to be able to value it in the context of partnership financial statements.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas