Zacotex Ltd, a manufacturer, produced the following financial information for the year ended 31 March 20X5. Additional

Question:

Zacotex Ltd, a manufacturer, produced the following financial information for the year ended 31 March 20X5.

Additional information

1. The inventories held at 31 March 20X5 were:

2. One-quarter of the administration expenses are to be allocated to the factory.

3. The raw materials purchases figure for the year includes a charge for carriage inwards. On 31 March 20X5 a credit note for £1,550 was received in respect of a carriage inwards overcharge. No adjustment had been made for this amount.

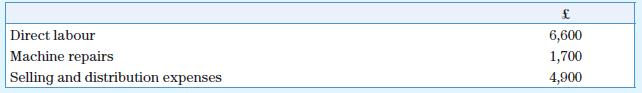

4. Expenses in arrears at 31 March 20X5 were:

5. Plant and machinery at 1 April 20X4:

During the year an obsolete machine (cost £30,000, depreciation to date £8,000) was sold as scrap for £5,000. On 1 October 20X4 new machinery was purchased for £70,000 with an installation charge of £8,000.

The company depreciates its plant and machinery at 10 per cent per annum on cost on all items in company ownership at the end of the accounting year.

6. An analysis of the sales of finished goods revealed the following:

7. On 1 April 20X4 the company arranged a long-term loan of £250,000 at a fixed rate of interest of 11 per cent per annum. No provision had been made for the payment of the interest.

Required

Prepare for the year ended 31 March 20X5

a. A manufacturing account showing prime cost and factory cost of goods produced.

b. A statement of profit or loss.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas