1. Reconsider Exhibits 13.3 and 13.4 on pp. 592 and 593. Suppose production in 20X1 was 14,500...

Question:

1. Reconsider Exhibits 13.3 and 13.4 on pp. 592 and 593. Suppose production in 20X1 was 14,500 units instead of 14,000 units, but sales remained at 16,000 units. Assume that the net variances for all variable manufacturing costs were €200,000, unfavorable. Regard these variances as adjustments to the standard cost of goods sold. Also assume that actual fixed costs were €1,570,000. Prepare income statements for 20X1 under variable costing and under absorption costing.

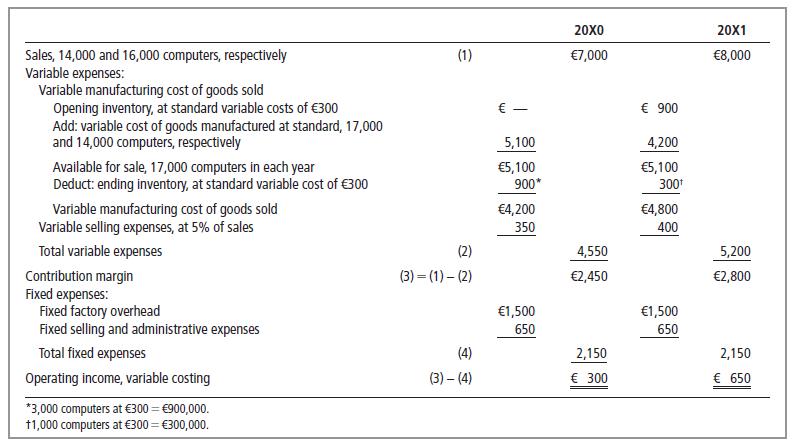

Exhibit 13.3

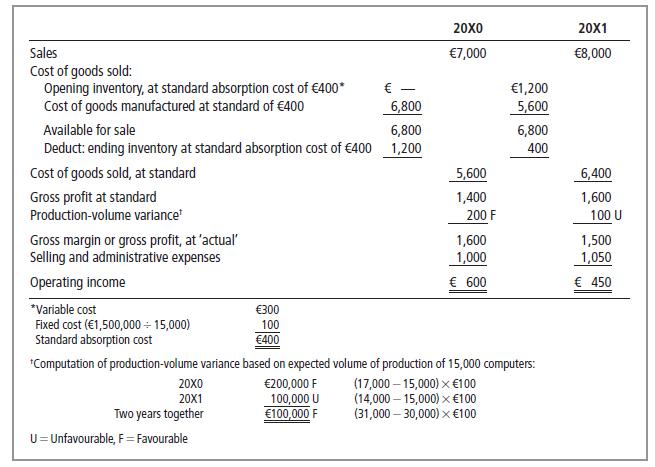

Exhibit 13.4

2. Explain why operating income was different under variable costing from what it was under absorption costing. Show your calculations.

3. Without regard to number 1, would variable costing or absorption costing give a manager more flexibility in influencing short-run operating income through production-scheduling decisions? Why?

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg