Exclusive Candles is a mid-size company that sells ultrasonic aroma diffusers and humidifiers with LED lights. On

Question:

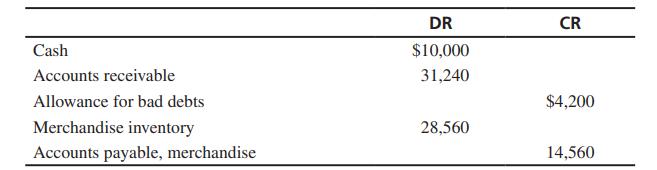

Exclusive Candles is a mid-size company that sells ultrasonic aroma diffusers and humidifiers with LED lights. On October 1, 2020, part of the trial balance showed the following:

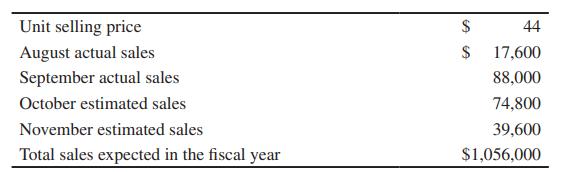

The company pays for its purchase within 15 days of purchase, so assume that half of the purchases of any month are due and paid for in the following month.

The cost of the merchandise purchased is $24 per box. At the end of each month, it is desired to have an inventory equal in units to 70% of the following month’s sales in units.

Sales terms include a 2% discount if payment is made by the end of the calendar month. Past experience indicates that 60% of sales will be collected during the month, 30% in the following calendar month, 5% in the next following calendar month, and the remaining 5% will be uncollectible. The company’s fiscal year begins August 1.

Exclusive of bad debts, total budgeted selling and general administration expenses for the fiscal year are estimated at $169,200, of which $54,000 is fixed expense (which includes $25,800 annual depreciation charge). The company incurs these fixed expenses uniformly throughout the year. The balance of the selling and administration expenses varies with sales. Expenses are paid as incurred. Prepare a statement of estimated cash receipts and disbursements for October 2020.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9781292412566

17th Edition, Global Edition

Authors: Charles Horngren, Gary L Sundem, Dave Burgstahler