Lamar Company is considering a project that would have a five-year life and require a $2,400,000 investment

Question:

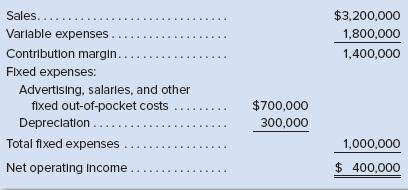

Lamar Company is considering a project that would have a five-year life and require a $2,400,000 investment in equipment. At the end of five years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows:

The company’s discount rate is 12%.

Required:

1. Compute the annual net cash inflow from the project.

2. Compute the project’s net present value. Is the project acceptable?

3. Find the project’s internal rate of return to the nearest whole percent.

4. Compute the project’s payback period.

5. Compute the project’s simple rate of return.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

ISE Introduction To Managerial Accounting

ISBN: 9781260091755

8th Edition

Authors: Peter Brewer, Ray Garrison, Eric Noreen

Question Posted: