The following events apply to Parker and Moates, a public accounting firm, for the Year 1 accounting

Question:

The following events apply to Parker and Moates, a public accounting firm, for the Year 1 accounting period:

1. Performed $96,000 of services for clients on account.

2. Performed $65,000 of services for cash.

3. Incurred $45,000 of other operating expenses on account.

4. Paid $26,000 cash to an employee for salary.

5. Collected $70,000 cash from accounts receivable.

6. Paid $38,000 cash on accounts payable.

7. Paid a $10,000 cash dividend to the stockholders.

8. Accrued salaries were $3,000 at the end of Year 1.

Required

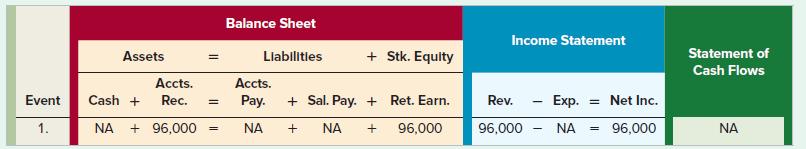

a. Show the effects of the events on the financial statements using a horizontal financial statements model like the following one. In the Statements of Cash Flows column, use OA to designate operating activity, IA for investment activity, FA for financing activity, and NC for net change in cash. Use NA to indicate that the model is not affected by the event. The first event is recorded as an example.

b. What is the amount of total assets at the end of Year 1?

c. What is the balance of accounts receivable at the end of Year 1?

d. What is the balance of accounts payable at the end of Year 1?

e. What is the difference between accounts receivable and accounts payable?

f. What is net income for Year 1?

g. What is the amount of net cash flow from operating activities for Year 1?

Step by Step Answer:

Introductory Financial Accounting For Business

ISBN: 9781260575309

2nd Edition

Authors: Thomas Edmonds, Christopher Edmonds, Mark Edmonds, Jennifer Edmonds, Philip Olds