Daley Company was started on January 1, Year 1, and experienced the following events during its first

Question:

Daley Company was started on January 1, Year 1, and experienced the following events during its first year of operation:

1. Acquired $52,000 cash from the issue of common stock.

2. Borrowed $20,000 cash from National Bank.

3. Earned cash revenues of $42,000 for performing services.

4. Paid cash expenses of $23,000.

5. Paid a $6,000 cash dividend to the stockholders.

6. Acquired an additional $10,000 cash from the issue of common stock.

7. Paid $10,000 cash to reduce the principal balance of the bank note.

8. Paid $45,000 cash to purchase land.

9. Determined that the market value of the land is $55,000.

Required

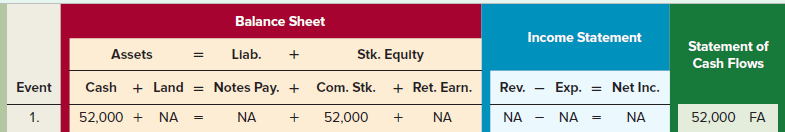

a. Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). The first event is shown as an example.

b. Determine the amount of total assets that Daley would report on the December 31, Year 1, balance sheet.

c. Identify the asset source transactions and related amounts for Year 1.

d. Determine the net income that Daley would report on the Year 1 income statement. Explain why dividends do not appear on the income statement.

e. Determine the net cash flows from operating activities, financing activities, and investing activities that Daley would report on the Year 1 statement of cash flows.

f. Determine the percentage of assets provided by investors, creditors, and earnings.

g. What is the balance in the Retained Earnings account immediately after Event 3 is recorded?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds