During the first year of operation, Year 1, Home Renovation recognized $261,000 of service revenue on account.

Question:

During the first year of operation, Year 1, Home Renovation recognized $261,000 of service revenue on account. At the end of Year 1, the accounts receivable balance was $46,300. Even though this is his first year in business, the owner believes he will collect all but about 4 percent of the ending balance.

Required

a. What amount of cash was collected by Home Renovation during Year 1?

b. Assuming the use of an allowance system to account for uncollectible accounts, what amount should Home Renovation record as uncollectible accounts expense in Year 1?

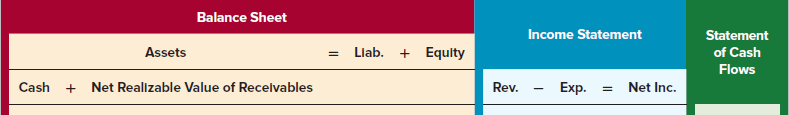

c. Show the effects of the following three transactions on the financial statements by recording the appropriate amounts in a horizontal statements model like the one shown next. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA for not affected.

(1) Record service revenue on account.

(2) Record collection of accounts receivable.

(3) Record the entry to recognize uncollectible accounts expense.

d. What is the net realizable value of receivables at the end of Year 1?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds