Mott Company has a line of credit with Bay Bank. Mott can borrow up to $400,000 at

Question:

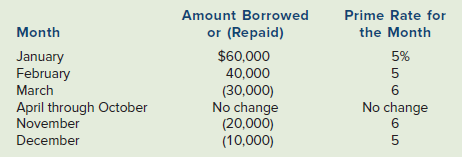

Mott Company has a line of credit with Bay Bank. Mott can borrow up to $400,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage, along with the amounts borrowed and repaid during Year 1. Mott agreed to pay interest at an annual rate equal to 1 percent above the bank’s prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Mott pays 6 percent (5 percent + 1 percent) annual interest on $60,000 for the month of January.

Mott earned $25,000 of cash revenue during Year 1.

Required

a. Prepare an income statement, balance sheet, and statement of cash flows for Year 1.

b. Write a memo discussing the advantages to a business of arranging a line of credit.

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds