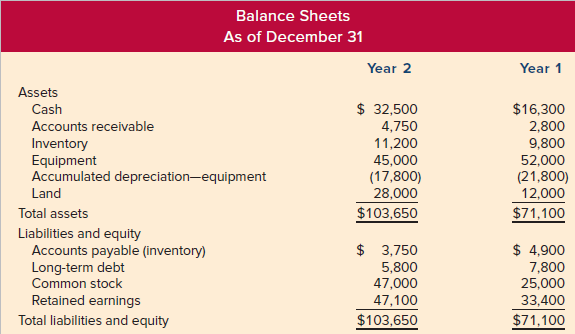

The comparative balance sheets and income statements for Gypsy Company follow. Income Statement For the Year Ended

Question:

The comparative balance sheets and income statements for Gypsy Company follow.

Income Statement

For the Year Ended December 31, Year 2

Sales revenue ..........................................................$61,200

Cost of goods sold ..................................................(24,500)

Gross margin ..........................................................36,700

Depreciation expense ............................................(12,000)

Operating income ..................................................24,700

Gain on sale of equipment ...................................1,500

Loss on disposal of land .......................................(100)

Net income ............................................................$26,100

Additional Data

1. During Year 2, the company sold equipment for $21,500; it had originally cost $36,000. Accumulated depreciation on this equipment was $16,000 at the time of the sale. Also, the company purchased equipment for $29,000 cash.

2. The company sold land that had cost $6,000. This land was sold for $5,900, resulting in the recognition of a $100 loss. Also, common stock was issued in exchange for title to land that was valued at $22,000 at the time of exchange.

3. Paid dividends of $12,400.

Required

Prepare a statement of cash flows using the indirect method.

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds