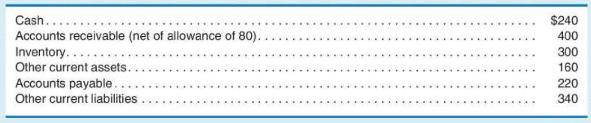

The following data are from the current accounting records of Crest Company: The president of the company

Question:

The following data are from the current accounting records of Crest Company:

The president of the company is concerned that the company may be in violation of a debt covenant that requires the company to maintain a minimum current ratio of 2.0 . He believes the best way to rectify the problem is to reverse a bad debt write-off in the amount of \(\$ 20\) that the company just recorded. He argues that the write-off was done too early and that the collections department should be given more time to collect the outstanding amounts. The CFO argues that this will have no effect on the current ratio, so a better idea is to use \(\$ 20\) of cash to pay accounts payable early.

Required

a. Which idea, the president's or the CFO's, is better for attaining a minimum 2.0 current ratio?

b. Will either the quick ratio or the times-interest-earned ratios be affected by either of these ideas?

Step by Step Answer: