The Midwestern Manufacturing Company uses the LIFO inventory costing method to value its ending inventory. The following

Question:

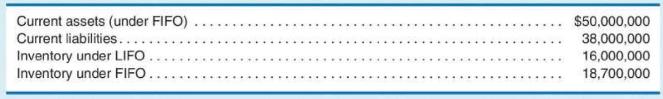

The Midwestern Manufacturing Company uses the LIFO inventory costing method to value its ending inventory. The following data were obtained from the company's accounting records:

Calculate the company's

(a) LIFO inventory reserve

(b) current ratio assuming (i) FIFO and (ii) LIFO. If the company's LIFO gross profit was \(\$ 18,000,000\) and the change in the LIFO inventory reserve was \(\$ 3,000,000\), calculate the company's gross profit under FIFO.

Transcribed Image Text:

Current assets (under FIFO) Current liabilities..... Inventory under LIFO. Inventory under FIFO.. $50,000,000 38,000,000 16,000,000 18,700,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Alaska Manufacturing Company uses the LIFO inventory costing method to value its ending inventory. The following data were obtained from the company's accounting records: Calculate the company's (a)...

-

Southeast Steel Company uses the LIFO inventory costing method to value its ending inventory. The following data were obtained from the company's accounting records: Calculate the company's (a) LIFO...

-

Eastern Steel Company uses the LIFO inventory costing method to value its ending inventory. The following data were obtained from the company's accounting records: Calculate the company's (a) LIFO...

-

Which of the following cannot be instantiated directly by the caller using the constructor? (Choose two.) A. Locale B. ResourceBundle C. Locale.Builder D. Properties E. DateTimeFormatter F. HashMap

-

The concentration of Cu2+ ions in the water (which also contains sulfate ions) discharged from a certain industrial plant is determined by adding excess sodium sulfide (Na2S) solution to 0.800 L of...

-

In problem, sketch the graph of each function. Be sure to label three points on the graph. f(x) = 3

-

When does it make sense for an organization to consider forming an endowment? How would an endowment influence the need for fundraising?

-

Illustrate the effects on the accounts and financial statements of the following transactions in the accounts of Laser Tech Co., a hospital supply company that uses the direct write-off method of...

-

8 . Alice Corporations has two divisions. The one in the high - risk industry has a beta of 1 . 5 and can be financed optimally in line with others in the industry at 2 5 % debt and 7 5 % equity. The...

-

Using the data in P6-8B, assume that Cracker Corporation uses the perpetual inventory system. Calculate the value of ending inventory and cost of goods sold for the year using the perpetual method...

-

Refer to the information in P6-4B and assume the perpetual inventory system is used. Required a. Assume that Glenn uses the first-in, first-out method. Compute the cost of goods sold for 2018 and the...

-

A mass weighing 8 pounds is attached to a spring. When set in motion, the spring/mass system exhibits simple harmonic motion. (a) Determine the equation of motion if the spring constant is 1 lb/ft...

-

Plantation Green Limited is a major producer of processed coffee. On the 17 July 2018, it agreed to sell 200 kilograms of coffee to Grey-Drinks Restaurant. Both parties are located in X country in...

-

1. The following data are available for the Lawrence Manufacturing Company for the year 2017, and 2018, its first and second years of operations: 2017 2018 Beginning inventory in units 0? Units...

-

What roles do customers play in terms of loyalty programs?

-

You have estimated the single index model ( SIM ) fund B and found that its alpha and beta are 0 . 0 3 5 and 1 . 1 respectively. The standard deviation of Fund B \' s excess returns is 3 0 % and the...

-

Your supervising attorney is ready to draft a trust for a client. The attorney needs to know which provisions are needed in the trust. Complete the following information. You may create 'make up'...

-

(a) Show that the rate of change of the free-fall acceleration with distance above the Earths surface is dg/dr = 2GME/RE3 This rate of change over distance is called a gradient. (b) If h is small in...

-

Which of the following statements is false? a. Capital leases are not commonly reported in a Capital Projects Fund. b. A governmental entity may report a Capital Project Fund in one year but not the...

-

The statements about Public companies that is untrue is? Public companies must have a minimum of 3 directors. Public companies do not need to have their financial statements audited if the annual...

-

DJ Corporation manufactures gadgets. At the end of the period, DJ has $18,600 of finished gadgets, $5,400 of work-in-process gadgets, and $11,000 in raw materials onsite. It also has the following...

-

What are two potential remedies of a mortgagee when there is a mortgage default? ( Alberta, Canada)

Study smarter with the SolutionInn App