The Pet Store experienced the following events for the Year 1 accounting period: 1. Acquired $60,000 cash

Question:

The Pet Store experienced the following events for the Year 1 accounting period:

1. Acquired $60,000 cash from the issue of common stock.

2. Purchased $65,000 of inventory on account.

3. Received goods purchased in Event 2 FOB shipping point; freight cost of $900 paid in cash.

4. Sold inventory on account that cost $38,000 for $71,000.

5. Freight cost on the goods sold in Event 4 was $620. The goods were shipped FOB destination. Cash was paid for the freight cost.

6. Customer in Event 4 returned $4,200 worth of goods that had a cost of $2,150.

7. Collected $58,300 cash from accounts receivable.

8. Paid $59,200 cash on accounts payable.

9. Paid $2,600 for advertising expense.

10. Paid $3,100 cash for insurance expense.

Required

a. Which of these events affect period (selling and administrative) costs? Which result in product costs? If neither, label the transaction NA.

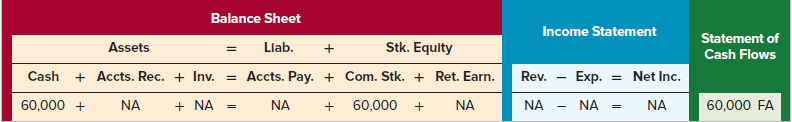

b. Show each event in a horizontal financial statements model like the following one. The first event is recorded as an example.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds