The two employees of Silver Co. receive various fringe benefits. Silver Co. provides vacation at the rate

Question:

The two employees of Silver Co. receive various fringe benefits. Silver Co. provides vacation at the rate of $315 per day. Each employee earns one day of vacation per month worked. In addition, Silver Co. pays a total amount of $650 per month in medical insurance premiums. Silver also contributes a total amount of $400 per month into an employee retirement plan. The federal unemployment tax rate is 6%, while the state unemployment tax rate is 4%. Unemployment taxes apply to the first $7,000 of earnings per employee. Assume a Social Security tax rate of 6% and a Medicare tax rate of 1.5%.

Required

a. Prepare the computation of accrued fringe benefits per month.

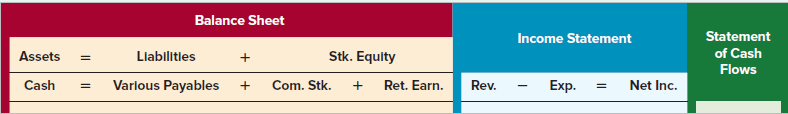

b. Show the effect of accrued fringe benefits per month on a horizontal statements model like the one shown next:

c. If the two employees each worked 250 days, what is Silver Co.’s total payroll cost (salary, payroll taxes, and fringe benefits) for the year? (Assume that each employee earns $315 per day.)

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds