As noted previously, P/E is a price multiple frequently used by analysts. Using P/E in the method

Question:

As noted previously, P/E is a price multiple frequently used by analysts. Using P/E in the method of comparables can be problematic, however, as a result of business cycle effects on EPS. An alternative valuation tool that is useful during periods of economic slowdown or extraordinary growth is the P/S multiple. Although sales will decline during a recession and increase during a period of economic growth, the change in sales will be less than the change in earnings in percentage terms because earnings are heavily influenced by fixed operating and financing costs (operating and financial leverage).

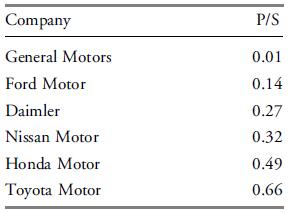

The following data provide the P/S for most of the major automobile manufacturers in early 2009 (from the Value Line stock screener):

Which stock appears to be undervalued when compared with the others?

Step by Step Answer:

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard