Based on Azarovs statement concerning ERISA and ASC 715, which of the following statements is correct? A.

Question:

Based on Azarov’s statement concerning ERISA and ASC 715, which of the following statements is correct?

A. Maglav is not allowed to terminate the plan.

B. Maglav can exclude the plan’s service costs from net income.

C. Maglav’s plan must appear as an asset on Maglav’s balance sheet.

William Azarov is a portfolio manager for Westcome Investments, an asset management firm.

Azarov is preparing for meetings with two of Westcome’s clients and obtains the help of Jason Boulder, a junior analyst. The first meeting is with Maglav Inc., a rapidly growing US-based technology firm with a young workforce and high employee turnover. Azarov directs Boulder to review the details of Maglav’s defined benefit (DB) pension plan. The plan is overfunded and has assets under management of \($25\) million. Boulder makes the following two observations:

Observation 1: Maglav’s shareholders benefit from the plan’s overfunded status.

Observation 2: The funded ratio of Maglav’s plan will decrease if employee turnover decreases.

Maglav outsources the management of the pension plan entirely to Westcome Investments. The fee structure requires Maglav to compensate Westcome with a high base fee regardless of performance. Boulder tells Azarov that outsourcing offers small institutional investors, such as Maglav’s pension plan, the following three benefits:

Benefit 1: Regulatory requirements are reduced.

Benefit 2: Conflicts of interest are eliminated from principal–agent issues.

Benefit 3: Investors have access to a wider range of investment strategies through scale benefits.

In the meeting with Maglav, Azarov describes the investment approach used by Westcome in managing the pension plan. The approach is characterized by a high allocation to alternative investments, significant active management, and a reliance on outsourcing assets to other external asset managers. Azarov also explains that Maglav’s operating results have a low correlation with pension asset returns and that the investment strategy is affected by the fact that the pension fund assets are a small portion of Maglav’s market capitalization. Azarov states that the plan is subject to the Employee Retirement Income Security Act of 1974 (ERISA) and follows generally accepted accounting principles, including Accounting Standards Codification (ASC) 715, Compensation—Retirement Benefits.

Azarov’s second meeting is with John Spintop, chief investment officer of the Wolf University Endowment Fund (the Fund). Spintop hired Westcome to assist in developing a new investment policy to present to the Fund’s board of directors. The Fund, which has assets under management of \($200\) million, has an overall objective of maintaining long-term purchasing power while providing needed financial support to Wolf University. During the meeting, Spintop states that the Fund has an annual spending policy of paying out 4% of the Fund’s three-year rolling asset value to Wolf University, and the Fund’s risk tolerance should consider the following three liability characteristics:

Characteristic 1: The Fund has easy access to debt markets.

Characteristic 2: The Fund supports 10% of Wolf University’s annual budget.

Characteristic 3: The Fund receives significant annual inflows from gifts and donations.

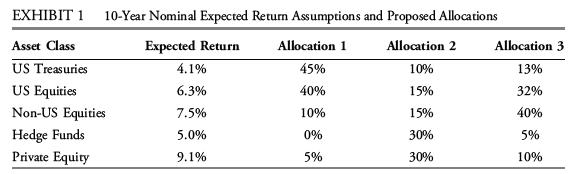

The Fund has a small investment staff with limited experience in managing alternative assets and currently uses the Norway model for its investment approach. Azarov suggests a change in investment approach by making an allocation to externally managed alternative assets—namely, hedge funds and private equity. Ten-year nominal expected return assumptions for various asset classes, as well as three proposed allocations that include some allocation to alternative assets, are presented in Exhibit 1.

Expected inflation for the next 10 years is 2.5% annually.

Step by Step Answer: