Based on Exhibit 1, the capture ratios of the portfolio indicate: A. a concave return profile. B.

Question:

Based on Exhibit 1, the capture ratios of the portfolio indicate:

A. a concave return profile.

B. positive asymmetry of returns.

C. that the portfolio generates higher returns than the benchmark during all market conditions.

Alexandra Jones, a senior adviser at Federalist Investors (FI), meets with Erin Bragg, a junior analyst. Bragg just completed a monthly performance evaluation for an FI fixed-income manager. Bragg’s report addresses the three primary components of performance evaluation:

measurement, attribution, and appraisal. Jones asks Bragg to describe an effective attribution process. Bragg responds as follows:

Response 1: Performance attribution draws conclusions regarding the quality of a portfolio manager’s investment decisions.

Response 2: Performance attribution should help explain how performance was achieved by breaking apart the return or risk into different explanatory components.

Bragg notes that the fixed-income portfolio manager has strong views about the effects of macroeconomic factors on credit markets and follows a top-down investment process.

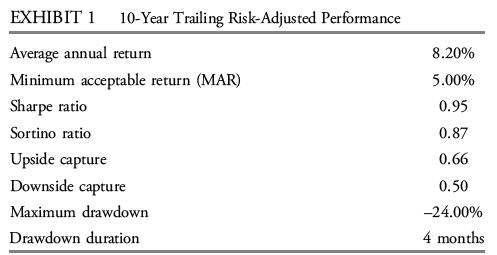

Jones reviews the monthly performance attribution and asks Bragg whether any riskadjusted historical performance indicators are available. Bragg produces the following data:

Step by Step Answer: