Discuss how Smiths stated expectation would be reflected in estimated portfolio risk under the fee structure identified

Question:

Discuss how Smith’s stated expectation would be reflected in estimated portfolio risk under the fee structure identified by Porter.

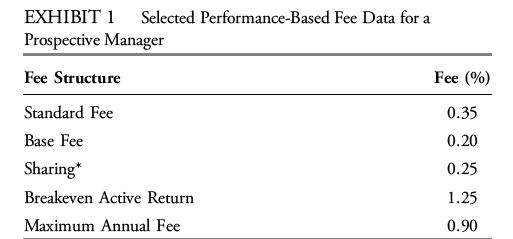

After narrowing their choice to three managers with different fee structures, Porter and Smith analyze the effect of the performance-based fee structure for each manager. Exhibit A provides applicable data for one of the managers.

To understand the effect each fee structure has on its respective portfolio, Porter and Smith must estimate the net active return for several possible gross active returns, including less than or equal to 0.20%, 0.75%, 1.25%, and 1.75%.

Jack Porter and Melissa Smith are co-managers for the Circue Library Foundation (Circue) in Canada. Within the next six months, Porter and Smith will be replacing one of Circue’s underperforming active managers. This choice will rely on the terms of investment management contracts—specifically, liquidity and management fee structure. Circue’s IPS indicates some tolerance for lower liquidity, a moderate sensitivity to management fees, and a heightened sensitivity to closet indexing.

Circue is considering the following three investment vehicles with distinct fee structures:

• Hedge funds with a soft lock • Open-end funds with an incentive fee • Closed-end funds with no incentive fee

Step by Step Answer: