Discuss two estate planning objectives revealed in Hinkles discussion with Enlow. Enlow wants to transfer some of

Question:

Discuss two estate planning objectives revealed in Hinkle’s discussion with Enlow.

Enlow wants to transfer some of his wealth to his niece and nephew but isn’t sure whether he should use lifetime gifts or testamentary bequests. The present value of the amount that he wants to transfer to each of them is $50,000.

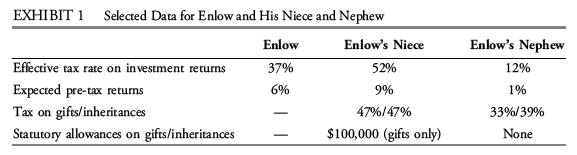

Enlow’s niece has a high income and is an aggressive and successful investor. Enlow’s nephew, in contrast, has a low income and minimal interest in investing. Selected data for Enlow and his niece and nephew are presented in Exhibit 1.

Enlow asks Hinkle to advise him of the most tax-efficient way to make each wealth transfer. For the analysis, Hinkle assumes that the bequests, if chosen, would happen in 10 years.

Tesando Omo is a highly successful entrepreneur. The software company that he started five years ago is now worth $200 million. It is a private company, and he is the controlling owner, with a 60% equity share. His only other investment is a position in the publicly traded shares of his previous employer, which he acquired by exercising stock options six years ago. This publicly traded share position has substantially increased in value and is now worth $36 million.

Omo recently sought financial advice from Umae Jing. After discussing Omo’s personal situation and financial goals, Jing expresses concern about Omo’s current portfolio and points out several important risk and tax-related considerations that are relevant to Omo’s portfolio.

Step by Step Answer: