Discuss whether the current investment policy is appropriate given the Endowments annual spending policy. Upon completion of

Question:

Discuss whether the current investment policy is appropriate given the Endowment’s annual spending policy.

Upon completion of the investment policy review by her four-person staff, the CIO makes some recommendations to the Endowment’s board regarding the investment objectives and asset allocation. One of her recommendations is to adopt the endowment model as an investment approach. She recommends investing 20% in private equity, 40% in hedge funds, 25% in public equities, and 15% in fixed income.

The Prometheo University Scholarship Endowment (the Endowment) was established in 1950 and supports scholarships for students attending Prometheo University. The Endowment’s assets under management are relatively small, and it has an annual spending policy of 6% of the five-year rolling asset value.

15. Formulate the investment objectives section of the investment policy statement for the Endowment.

Prometheo University recently hired a new chief investment officer (CIO). The CIO directs her small staff of four people to implement an investment policy review. Historically, the endowment has invested 60% of the portfolio in US equities and 40% in US Treasuries.

The CIO’s expectation of annual inflation for the next 10 years is 2.5%.

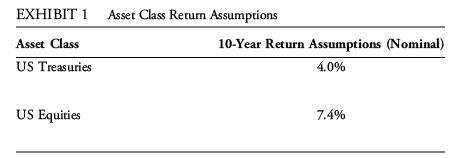

The CIO develops nominal 10-year return assumptions for US Treasuries and US equities, which are presented in Exhibit 1.

Step by Step Answer: