Don Murray, an economist, is president of the investment committee of a large U.S. pension plan. He

Question:

Don Murray, an economist, is president of the investment committee of a large U.S. pension plan. He is reviewing the plan’s recent investment returns and finds that non-U.S. equity returns have been much higher than U.S. equity returns. Before making any changes to the plan’s asset allocation, he has asked to meet with Susan McLean, CFA, who is responsible for the equity portion of the pension plan assets. Murray wants to discuss with McLean the current valuation levels of various equity markets.

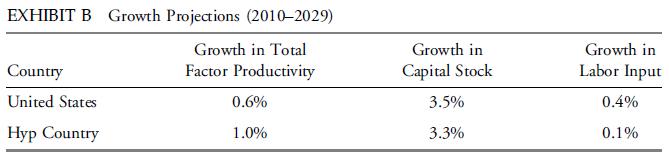

Murray develops his own growth projections for the United States and for a hypothetical country (Hyp Country) that enjoys a well-developed economy but whose population is aging. These projections are shown in Exhibit B. In addition, Murray projects that output elasticity of capital equals 0.3 and 0.5 for the United States and Hyp Country, respectively.

A. Based on the information in Exhibit B, calculate the projected GDP growth for the United States for the period 2010–2029. Use the Cobb-Douglas production function and assume constant returns to scale.

Murray identifies two possible measures that the government of Hyp Country could implement and he wants to know how these measures would affect projected GDP growth for Hyp Country.

Measure 1: Lower the retirement age from 65 to 63, gradually over the next four-year period Measure 2: Reduce subsidies to higher education over the next five years B. For each of the growth measures identified by Murray in Exhibit B, indicate which growth factor is most affected. Justify your answers.

Murray is surprised that the bottom-up forecasts produced by McLean for the United States in the last five years have been consistently more optimistic than her topdown forecasts. As a result, he expresses doubt about the validity of either approach.

C. State one justification for using both top-down and bottom-up models even when these models produce different forecasts and state one justification for using the bottom-up approach by itself.

Murray suggests replacing earnings-based models with asset-based models in valuing equity markets. In response, McLean recommends using Tobin’s q ratio and equity q ratio, although both are subject to estimation errors when applied to valuing a particular company.

D. Identify two problems that McLean may have in estimating the Tobin’s q ratio and the equity q ratio for the pension plan assets that she manages.

Step by Step Answer:

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard