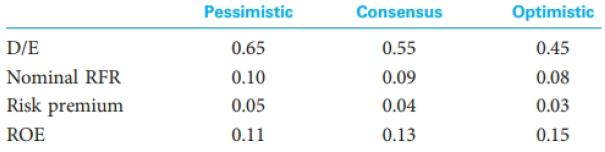

Given the three EPS estimates in Problem 5, you are also given the following estimates related to

Question:

Given the three EPS estimates in Problem 5, you are also given the following estimates related to the market earnings multiple:

a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P 500 Index in 2018.

b. Assuming that the S&P 500 Index at the beginning of the year was priced at 2,050, compute your estimated rate of return under the three scenarios from part (a). Assuming that your required rate of return is equal to the consensus, how would you weight the S&P 500 Index in your global portfolio?

Data From Problem 5

You are given the following estimated per share data related to the S&P 500 Index for the year 2018:

Sales.............................$ 1,950.00

Depreciation........................98.00

Interest expense.................58.00

Step by Step Answer:

Investment Analysis and Portfolio Management

ISBN: 978-1305262997

11th Edition

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds