Identify the likely appropriate price benchmark for the LIM trade. Justify your response. Bradley also performs a

Question:

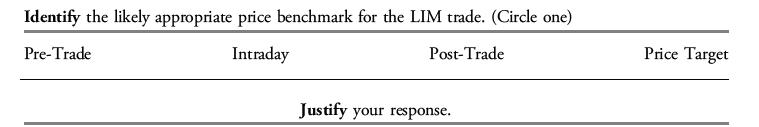

Identify the likely appropriate price benchmark for the LIM trade. Justify your response.

Bradley also performs a cost analysis on the LIM trade. Noting the time gap between his trade instructions and the order’s submission to the market, Bradley quantifies the cost of the delay.

Although focused on long-term value, North Circle Advisors will exploit temporary mispricings to open positions. For example, portfolio manager Bill Bradley pegged LIM Corporation’s fair value per share at \($28\) yesterday; however, LIM’s stock price seems to have overreacted to a competitor announcement prior to market open today. The follow events unfold over the course of the morning:

• PRIOR CLOSE: LIM closed at \($30.05\) • PRE-MARKET: LIM priced at \($20.34\) • MARKET OPEN: LIM opens at \($22.15\) • 10:00 AM: LIM trading at \($23.01\) • 10:00 AM: Bradley confirms the overreaction with target price of \($28\) • 10:05 AM: Bradley instructs trader to buy 25,000 shares, with a limit price of \($28\) when LIM is trading at \($23.09\) • 10:22 AM: Trader finishes the buy with an average purchase price of \($23.45\) Bradley and the trader conduct a post-trade evaluation. In picking an appropriate reference price, the trader asks Bradley if that would be a pre-trade, intraday, post-trade, or price target benchmark.

Step by Step Answer: