Which characteristic suggested by Knight to describe the quantitative approach to active management is incorrect? A. Characteristic

Question:

Which characteristic suggested by Knight to describe the quantitative approach to active management is incorrect?

A. Characteristic 1 B. Characteristic 2 C. Characteristic 3 Aleksy Nowacki is a new portfolio manager at Heydon Investments. The firm currently offers a single equity fund, which uses a top-down investment strategy based on fundamentals.

Vicky Knight, a junior analyst at Heydon, assists with managing the fund.

Nowacki has been hired to start a second fund, the Heydon Quant Fund, which will use quantitative active equity strategies. Nowacki and Knight meet to discuss distinct characteristics of the quantitative approach to active management, and Knight suggests three such characteristics:

Characteristic 1. The focus is on factors across a potentially large group of stocks.

Characteristic 2. The decision-making process is systematic and non-discretionary.

Characteristic 3. The approach places an emphasis on forecasting the future prospects of underlying companies.

Nowacki states that quantitative investing generally follows a structured and well-defined process. Knight asks Nowacki:

“What is the starting point for the quantitative investment process?”

The new Heydon Quant Fund will use a factor-based strategy. Nowacki assembles a large dataset with monthly standardized scores and monthly returns for the strategy to backtest a new investment strategy and calculates the information coefficient. FS(t) is the factor score for the current month, and FS(t þ 1) is the score for the next month. SR(t) is the strategy’s holding period return for the current month, and SR(t þ 1) is the strategy’s holding period return for the next month.

As an additional step in backtesting of the strategy, Nowacki computes historical price/

book ratios (P/Bs) and price/earnings ratios (P/Es) using calendar year-end (31 December)

stock prices and companies’ financial statement data for the same calendar year. He notes that the financial statement data for a given calendar year are not typically published until weeks after the end of that year.

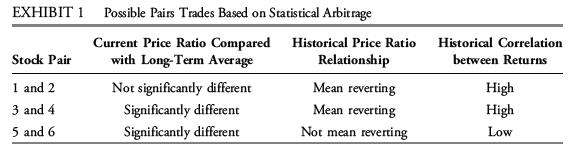

Because the Heydon Quant Fund occasionally performs pairs trading using statistical arbitrage, Nowacki creates three examples of pairs trading candidates, presented in Exhibit 1.

Nowacki asks Knight to recommend a suitable pair trade.

Knight foresees a possible scenario in which the investment universe for the Heydon Quant Fund is unchanged but a new factor is added to its multifactor model. Knight asks Nowacki whether this scenario could affect the fund’s investment-style classifications using either the returns-based or holdings-based approaches.

Step by Step Answer: