You work for a private wealth management firm that follows an external investment model, whereby it decides

Question:

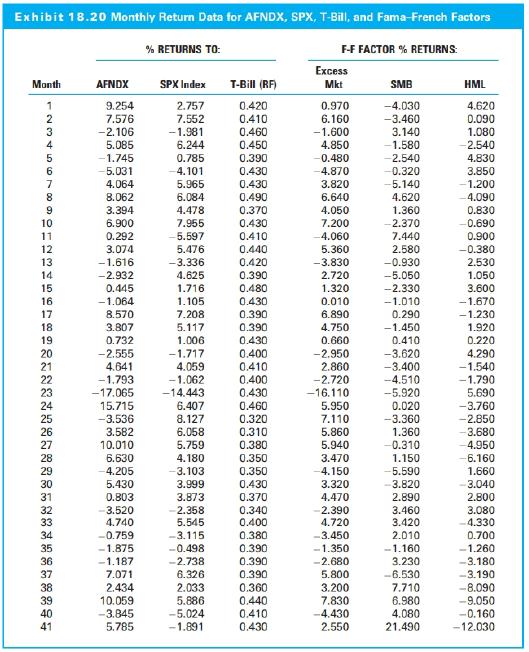

You work for a private wealth management firm that follows an "external investment" model, whereby it decides which outside managers it should recommend to clients. One mutual fund that is a candidate for inclusion on your Premier Recommended List of approved managers is Active Fund (AFNDX), an actively managed stock portfolio benchmarked to the Standard & Poor's 500 (SPX) Index. You have been asked to perform an evaluation of AFNDX's past investment performance, using a sample of monthly returns on the following positions: (l) AFNDX portfolio, (2) SPX Index, (3) U.S. Treasury bills, and (4) the three primary Fama-French risk factors (excess market, SMB, and HML). These data are listed in Exhibit 18.20

a. For both AFNDX and SPX, calculate the series of monthly risk premia (stated returns in excess of the risk-free rate) for the 41-month sample period. Use these excess return data to compute the Sharpe ratio for both AFNDX and SPX.

b. Based on a regression of the excess returns to AFNDX on the excess returns to SPX, use regression analysis to calculate the active manager's (I) one-factor Jensen's alpha coefficient, (2) beta coefficient, and (3) R-squared measure. Briefly explain what each of these statistics teUs you about how AFNDX has been managed.

c. Using your work in parts (a) and (b), calculate the Treynor ratio performance measures for both AFNDX and SPX, assuming a beta coefficient of 1.00 for the latter.

d. Compare what the Sharpe and Treynor measures indicate about the ability of AFNFX's manager to beat the market on a risk-adjusted basis. If the two measures give contradictory indications, reconcile that discrepancy.

e. Calculate the tracking error (TE) for AFNDX relative to the SPX benchmark, on both a monthly and an annualized basis. What does this TE error measure suggests about the consistency of the active manager's investment style and whether TE is at an appropriate level for a mutual fund manager?

f. Using the excess returns from part (a), compute the information ratio (IR) for AFNDX relative to the SPX benchmark on both a monthly basis and an annualized basis. Briefly explain what this IR suggests about the manager's investment prowess relative to the general equity market.

g. Estimate a regression of AFNDX's excess returns on the three Fama-French risk factors. Interpret each of the following components of your regression output: (1) the intercept coefficient, (2) the beta coefficients for each of the three independent variables, and (3) the R-squared measure. Explain what each of these statistics tells you about the manager's investment style and the ability for AFNDX to outperform market expectations.

h. Based on all of the preceding analysis, would you advise the senior management to include AFNDX on its Premier Recommended List of approved managers? Justify your decision.

Beta CoefficientBeta coefficient is a measure of sensitivity of a company's stock price to movement in the broad market index. It is an indicator of a stock's systematic risk which is the undiversifiable risk inherent in the whole financial system. Beta coefficient... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Investment Analysis and Portfolio Management

ISBN: 978-1305262997

11th Edition

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds