a. In Concept Check 16.1, you calculated the price and duration of a 2-year maturity, 8% coupon

Question:

a. In Concept Check 16.1, you calculated the price and duration of a 2-year maturity, 8% coupon bond making

semiannual coupon payments when the market interest rate is 9%. Now suppose the interest rate increases

to 9.05%. Calculate the new value of the bond and the percentage change in the bond’s price.

b. Calculate the percentage change in the bond’s price predicted by the duration formula in Equation 16.2 or

16.3. Compare this value to your answer for part (a).

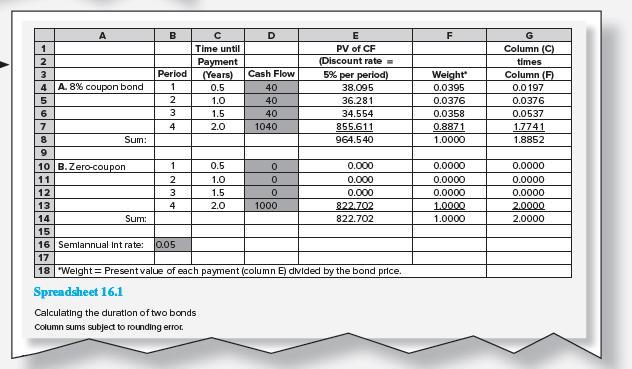

Concept Check 16.1

Suppose the interest rate decreases to 9% as an annual percentage rate. What will happen to the prices and durations of the two bonds in Spreadsheet 16.1?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

ISE Investments

ISBN: 9781260571158

12th International Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus

Question Posted: