The market timing strategy of Example 23.3 also can be achieved by an investor who holds an

Question:

The market timing strategy of Example 23.3 also can be achieved by an investor who holds an indexed stock portfolio and “synthetically exits” the position using futures if and when he turns pessimistic concerning the market. Suppose the investor holds $100 million of stock (which is 50,000 times the current value of the index).

What futures position added to the stock holdings would create a synthetic T-bill exposure when he is bearish on the market? Confirm that the profits are effectively risk-free using a table like that in Example 23.3.

Transcribed Image Text:

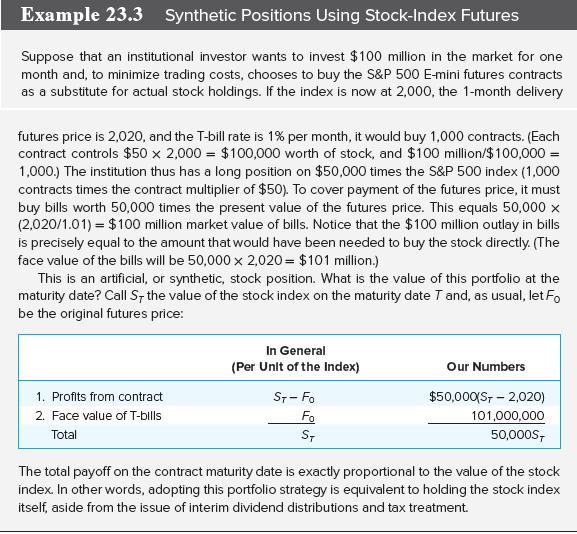

Example 23.3 Synthetic Positions Using Stock-Index Futures Suppose that an institutional investor wants to invest $100 million in the market for one month and, to minimize trading costs, chooses to buy the S&P 500 E-mini futures contracts as a substitute for actual stock holdings. If the index is now at 2,000, the 1-month delivery futures price is 2,020, and the T-bill rate is 1% per month, it would buy 1,000 contracts. (Each contract controls $50 x 2,000 = $100,000 worth of stock, and $100 million/$100,000 = 1,000.) The institution thus has a long position on $50,000 times the S&P 500 index (1,000 contracts times the contract multiplier of $50). To cover payment of the futures price, it must buy bills worth 50,000 times the present value of the futures price. This equals 50,000 x (2,020/1.01) = $100 million market value of bills. Notice that the $100 million outlay in bills is precisely equal to the amount that would have been needed to buy the stock directly. (The face value of the bills will be 50,000 x 2,020 = $101 million.) This is an artificial, or synthetic, stock position. What is the value of this portfolio at the maturity date? Call S, the value of the stock index on the maturity date T and, as usual, let Fo be the original futures price: In General (Per Unit of the Index) Our Numbers 1. Profits from contract 2. Face value of T-bills ST-Fo Fo $50,000 (S-2,020) 101,000,000 Total ST 50,000ST The total payoff on the contract maturity date is exactly proportional to the value of the stock index. In other words, adopting this portfolio strategy is equivalent to holding the stock index itself, aside from the issue of interim dividend distributions and tax treatment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

The net cash flow i...View the full answer

Answered By

Robert Mbae

I have been a professional custom essay writer for the last three years. Over that period of time, I have come to learn the value of focusing on the needs of the clients above everything else. With this knowledge, I have worked hard to become an acclaimed writer that can be trusted by the customers to handle the most important custom essays. I have the necessary educational background to handle projects up to the Ph.D. level. Among the types of projects that I've done, I can handle everything within Dissertations, Project Proposals, Research Papers, Term Papers, Essays, Annotated Bibliographies, and Literature Reviews, among others.

Concerning academic integrity, I assure you that you will receive my full and undivided attention through to the completion of every essay writing task. Additionally, I am able and willing to produce 100% custom writings with a guarantee of 0% plagiarism. With my substantial experience, I am conversant with all citation styles ranging from APA, MLA, Harvard, Chicago-Turabian, and their corresponding formatting. With all this in mind, I take it as my obligation to read and understand your instructions, which reflect on the quality of work that I deliver. In my paper writing services, I give value to every single essay order. Besides, whenever I agree to do your order, it means that I have read and reread your instructions and ensured that I have understood and interpreted them accordingly.

Communication is an essential part of a healthy working relationship. Therefore, I ensure that I provide the client with drafts way long before the deadline so that the customer can review the paper and comment. Upon completion of the paper writing service, the client has the time and right to review it and request any adjustments before releasing the payment.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

ISE Investments

ISBN: 9781260571158

12th International Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus

Question Posted:

Students also viewed these Business questions

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

6. Use the same set of information given in the problem above. (a) Use S&P 500 future prices to calculate the implied dividend yield on S&P 500. For simplicity, assume you can borrow or deposit money...

-

Q1. You have identified a market opportunity for home media players that would cater for older members of the population. Many older people have difficulty in understanding the operating principles...

-

Write a function named "count the" in C which counts the number of times a given word "the" appears in the string parameter. Test Data: Input: The string where the word the present more than once....

-

Light of a particular wavelength and intensity does not eject electrons from the surface of a given metal. Can electrons be ejected from the metal by increasing the intensity of the light? Explain.

-

The \(\frac{1}{2}\)-in.-diameter hose shown in Fig. P8.68 can withstand a maximum pressure of \(200 \mathrm{psi}\) without rupturing. Determine the maximum length, \(\ell\), allowed if the friction...

-

Must the economic ascent of nations such as China and India come at the price of decline in Europe and North America, or is it possible for economic conditions to simultaneously improve in all...

-

The following is a list of defalcations that have occurred within various organizations. You may assume that the amounts involved are material. Required For each defalcation, briefly indicate: a. How...

-

What is the definition of a data loop? Same track number used for two or more different tracks A unit receives the same data on more than one path Two or more tracks representing the same object...

-

Show how a firm that has issued a floating-rate bond with a coupon equal to the LIBOR rate can use swaps to convert that bond into synthetic fixed-rate debt. Assume the terms of the swap allow an...

-

United Millers purchases corn to make cornflakes. When the price of corn increases, the cost of making cereal increases, resulting in lower profits. Historically, profits per quarter have been...

-

Refer to the Real World Case on The New York Times and Boston Scientific in the chapter, and think about any technology-enabled innovations that you have read about or come across recently. To what...

-

This answers the question "why." What issue(s) does your project/program address? Why does it matter? Who benefits? Why is the project you're proposing the "best" way to meet the need(s)?

-

How the feedback will impact the module to edit and improve it prior to full implementation?

-

How can understanding various budgetary approaches make you valuable to a criminal justice employer? Understanding various budgetary approaches can make you valuable to a criminal justice employer in...

-

What is 1 strategy that can be implemented to enhance the recruitment, training, and retention of diverse professionals in the field, ensuring a more representative workforce that can effectively...

-

What is an essential philosophical underpinning of total quality management (TQM)?

-

The August Manufacturing Company in Rochester, Minnesota, assembles and tests electronic components used in handheld video phones. Consider the following data regarding component T24: The activities...

-

If the annual fixed costs are 54,000 dinars, the occupation expense represents 20%, the contribution margin is 25%, and the unit selling price is 40 dinars. Required: Calculate the closing point of...

-

Assume that interest rate parity holds. In both the spot market and the 90-day forward market 1 Japanese yen equals 0.0086 dollar. The 90-day risk-free securities yield 4.6 percent in Japan. What is...

-

In the spot market 7.8 pesos can be exchanged for 1 U.S. dollar. A compact disk costs $15 in the United States. If purchasing power parity holds, what should be the price of the same disk in Mexico?

-

Why is corporate finance important to all managers? MINI CASE Assume that you recently graduated with a degree in finance and have just reported to work as an investment advisor at the brokerage firm...

-

Explain the principles of process safety engineering in the context of chemical process industries, including hazard identification, risk assessment methodologies, and mitigation strategies for...

-

The Fleming Medical Group financial results are under budget for the first six months of 2022. Using the following table, calculate the volume, revenue, and cost variances for all variances greater...

-

Problem 3: (10 points) Determine the maximum live shear at C caused by the moving loads. 6 m 80 kN 60 kN 30 kN 30 kN B C 2 m -10 m. m Problem 4: (10 points) Determine the absolute positive maximum...

Study smarter with the SolutionInn App