A derivative security of European style with expiration in 1 year has this payoff: (max (0, min

Question:

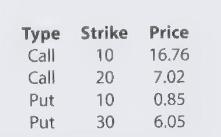

A derivative security of European style with expiration in 1 year has this payoff: \(\max (0, \min (3 K-S, S-K))\), where \(K=10\) is the strike price and \(S\) is the price of the underlying stock at expiration. The stock currently trades at 25 , and the following prices for European options on the stock are known (all expiring in 1 year):

(a) Draw the graph of the payoff as a function of \(S\).

(b) What is the 1-year interest rate \(r\) ?

(c) What is the price \(P\) of the derivative security?

Step by Step Answer:

Related Book For

Question Posted: