Assume that cash flow is given by (y=S_{T} W+left(F_{T}-F_{0} ight) h). Let (sigma_{S}^{2}=operatorname{var}left(S_{T} ight), sigma_{F}^{2}=operatorname{var}left(F_{T} ight)), and

Question:

Assume that cash flow is given by \(y=S_{T} W+\left(F_{T}-F_{0}\right) h\). Let \(\sigma_{S}^{2}=\operatorname{var}\left(S_{T}\right), \sigma_{F}^{2}=\operatorname{var}\left(F_{T}\right)\), and \(\sigma_{S T}=\operatorname{cov}\left(S_{T}, F_{T}\right)\).

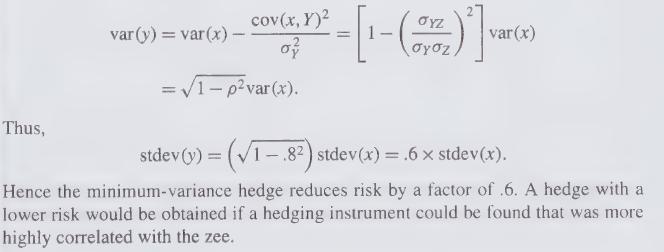

(a) In an equal and opposite hedge, \(h\) is taken to be an opposite equivalent dollar value of the hedging instrument. Therefore \(h=-k W\), where \(k\) is the price ratio between the asset and the hedging instrument. Express the standard deviation of \(y\) with the equal and opposite hedge in the form

(That is, find \(B\).)

(b) Apply this to Example 12.12 and compare with the minimum-variance hedge.

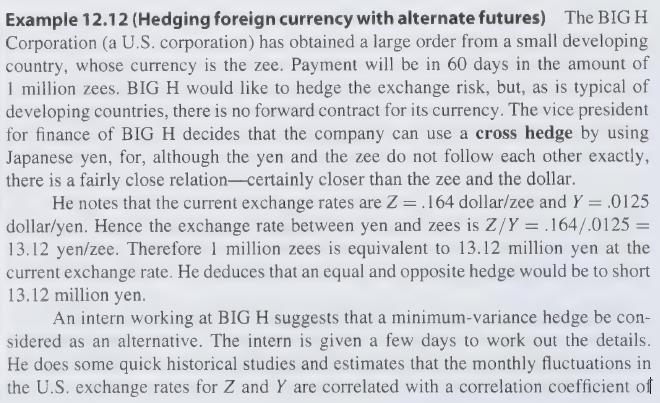

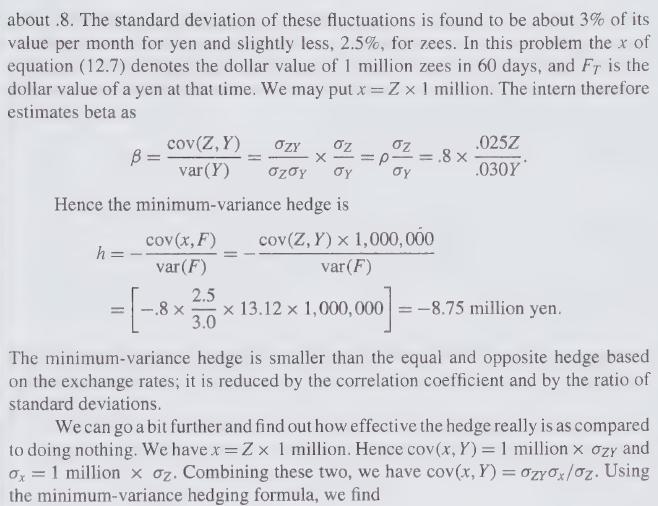

Data from Example 12.12

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: