Assuming the short rate process of Exercise 2 and risk-neutral probabilities of .5 , consider a zero-coupon

Question:

Assuming the short rate process of Exercise 2 and risk-neutral probabilities of .5 , consider a zero-coupon bond that pays \(\$ 1\) at time \(t=2\). Find the value at time \(t=0\) of this bond in two ways:

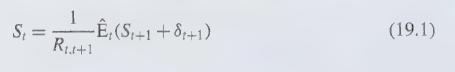

(a) Using the short rate lattice and equation (19.1).

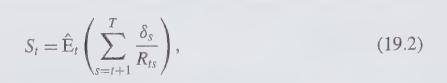

(b) Using the tree for \(R_{0 s}\) and equation (19.2).

Exercises 2

Consider a short rate binomial lattice where the risk-free rate at \(t=0\) is \(10 \%\). At \(t=1\) the rate is either \(10 \%\) (for the upper node) or \(0 \%\) (for the lower node). Trace out the growth of \(\$ 1\) invested risk free at \(t=0\) and rolled over at \(t=1\) for one more period. The values obtained at \(t=1\) and \(t=2\) correspond to \(R_{01}\) and \(R_{02}\). Show that these factors cannot be represented on a binomial lattice, but rather a full tree is required. Draw the tree.

Step by Step Answer: