Consider a payoff (C) that will occur in 2 years, taking one of the three possible values

Question:

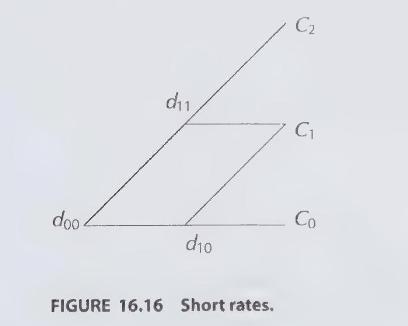

Consider a payoff \(C\) that will occur in 2 years, taking one of the three possible values \(C_{0}, C_{1}, C_{2}\). The short rate lattice for these 2 years is shown in Figure 16.16, with \(d_{i j}=\frac{1}{1+r_{i j}}\) being the short rate discount factors and all risk-neutral probabilities being 0.5 .

(a) What is the futures price \(F_{0}\) of \(C\) ?

(b) What is the forward price \(G_{0}\) of \(C\) ?

(c) Under what conditions will \(F_{0}=G_{0}\) for all possible \(C_{0}, C_{1}, C_{2}\) ?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: