Consider a perpetual American put option (with (T=infty) ). For small stock prices it will be advantageous

Question:

Consider a perpetual American put option (with \(T=\infty\) ). For small stock prices it will be advantageous to exercise the put. Let \(G\) be the largest such stock price. The time-independent Black-Scholes equation becomes

for \(G \leq S \leq \infty\). The appropriate boundary conditions are \(P(\infty)=0\) and \(P(G)=K-G\). \(G\) should be chosen to maximize the value of the option.

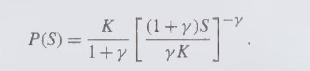

(a) Show that \(P(S)\) has the form

where \(\gamma=2 r / \sigma^{2}\).

(b) Use the two boundary conditions to show that

(c) Finally, choose \(G\) to maximize \(P(S)\) to conclude that

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: