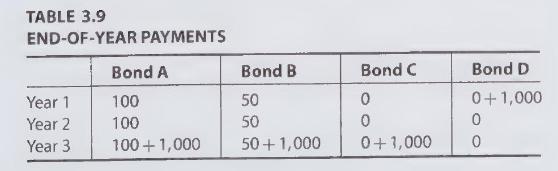

Consider the four bonds having annual payments as shown in Table 3.9. They are traded to produce

Question:

Consider the four bonds having annual payments as shown in Table 3.9. They are traded to produce a $15 %$ yield.

(a) Determine the price of each bond.

(b) Determine the duration of each bond (not the modified duration).

(c) Which bond is most sensitive to a change in yield?

(d) Suppose you owe $\$ 2,000$ at the end of 2 years. Concem about interest rate risk suggests that a portfolio consisting of the bonds and the obligation should be immunized. If $V_{\mathrm{A}}, V_{\mathrm{B}}, V_{\mathrm{C}}$, and $V_{\mathrm{D}}$ are the total values of bonds purchased of types $A, \mathrm{~B}, \mathrm{C}$, and $\mathrm{D}$, respectively, what are the necessary constraints to implement the immunization?

(e) In order to immunize the portfolio, you decide to use bond $\mathrm{C}$ and one other bond. Which other bond should you choose? Find the amounts (in total value) of each of these to purchase.

(f) You decided in (e) to use bond $\mathrm{C}$ in the immunization. Would other choices, including perhaps a combination of bonds, lead to lower total cost?

Step by Step Answer: