Someone who believes that the collection of all stocks satisfies a single-factor model with the market portfolio

Question:

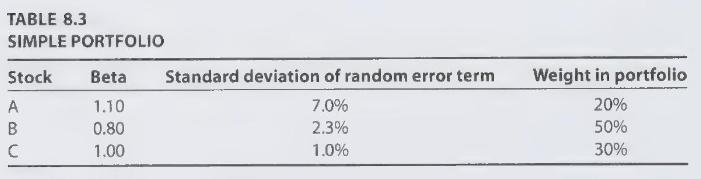

Someone who believes that the collection of all stocks satisfies a single-factor model with the market portfolio serving as the factor gives you information on three stocks which make up a portfolio. (See Table 8.3.) In addition, you know that the market portfolio has an expected rate of return of $12 %$ and a standard deviation of $18 %$. The risk-free rate is $5 %$.

(a) What is the portfolio's expected rate of return?

(b) Assuming the factor model is accurate, what is the standard deviation of this rate of return?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: