Table 201 illustrates how accounts are marked to market daily. Consider an investor who buys a stockindex

Question:

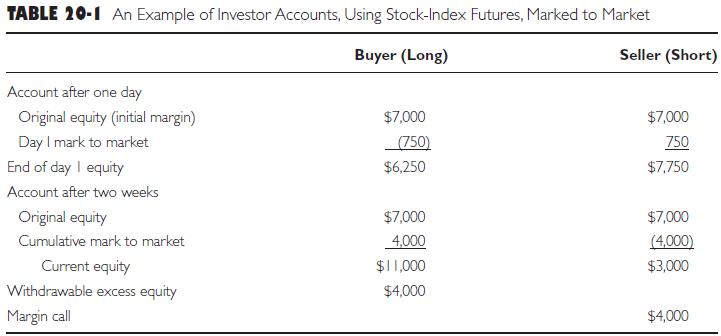

Table 20‐1 illustrates how accounts are marked to market daily. Consider an investor who buys a stock‐index futures contract on the DJJA using the CBOT® DJIASM futures contract. Assume that the investor’s brokerage firm requires an initial margin of $7,000 and a maintenance margin of $5,000.

Table 20‐1

This contract has a multiplier of $10. Price quotes are in points ($10), and the tick size is $10. The value of a CBOT DJIA futures contract is equal to $10 times the current index level. For example, if the index is trading at 18,000, one of these futures contracts is equivalent to investing $180,000 in the DJIA. The seller of such a contract (the short position) is agreeing to sell $10 times the index and the buyer (the long position) is agreeing to buy $10 times the index on the expiration date of the contract. On the settlement day of this futures contract, the final settlement price is $10 times the Special Opening Quotation of the index.

Assume that investor A buys a contract with the DJIA at 18,000 while investor B, believing the DJIA will decline, sells (goes short) one contract at the same time. After day one, the settlement price is 17,925. The buyer will have a debit in his/her account of 75 × $10 = $750 because the price declined and the buyer was long. Conversely, the seller will have a credit of the same amount in his/her account because the seller was short and the price declined. At the end of day 1, the value of the buyer’s account is $7,000 – $750 = $6,250, while the value of the seller’s account is $7,000 + $750 = $7,750. In effect, both accounts have been marked to market.

Now assume that two weeks have passed, during which time each account has been marked to market daily. The settlement price on this contract has reached 18,400, with a move on the last day of this two‐week period of 150 points. The aggregate change in market value for each investor is the difference between the current price and the initial price multiplied by $10, the value of one point in price. This will be

18,400 - 18,000 = 400 x $10 = $4,000

As shown in Table 20‐1, this amount is currently credited to the buyer because the price moved up as the buyer expected. Conversely, this same amount is debited to the seller, who is now on the wrong side of the price movement. Therefore, starting with an initial equity or margin of $7,000, after two weeks the cumulative mark to market is $4,000. This results in a current equity of $11,000 for the buyer and $3,000 for the seller. The buyer has a withdrawable excess equity of $4,000 because of the favorable price movement, whereas the seller now faces a margin call because the maintenance margin for this contract is $5,000. In this example, the market increased sharply on the last day of the two‐week period, bringing the seller’s equity below the required maintenance level. The seller would have to deposit funds to return the account to the initial margin requirement level of $7,000.

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen