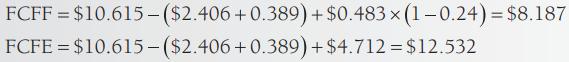

Using data from Exhibits 152 and 153, the FCFF and FCFE for CocaCola for 2014 are as

Question:

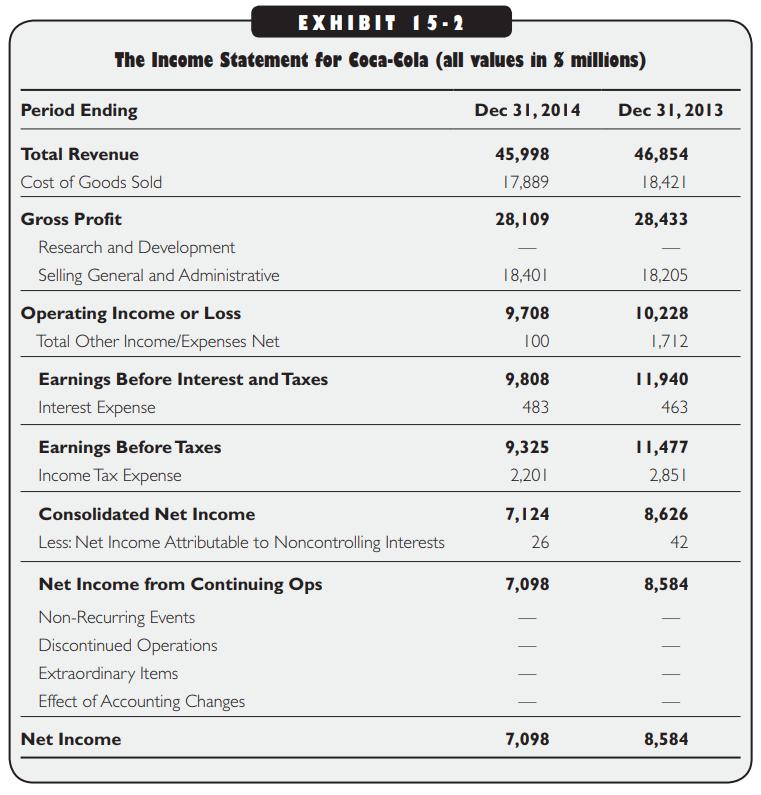

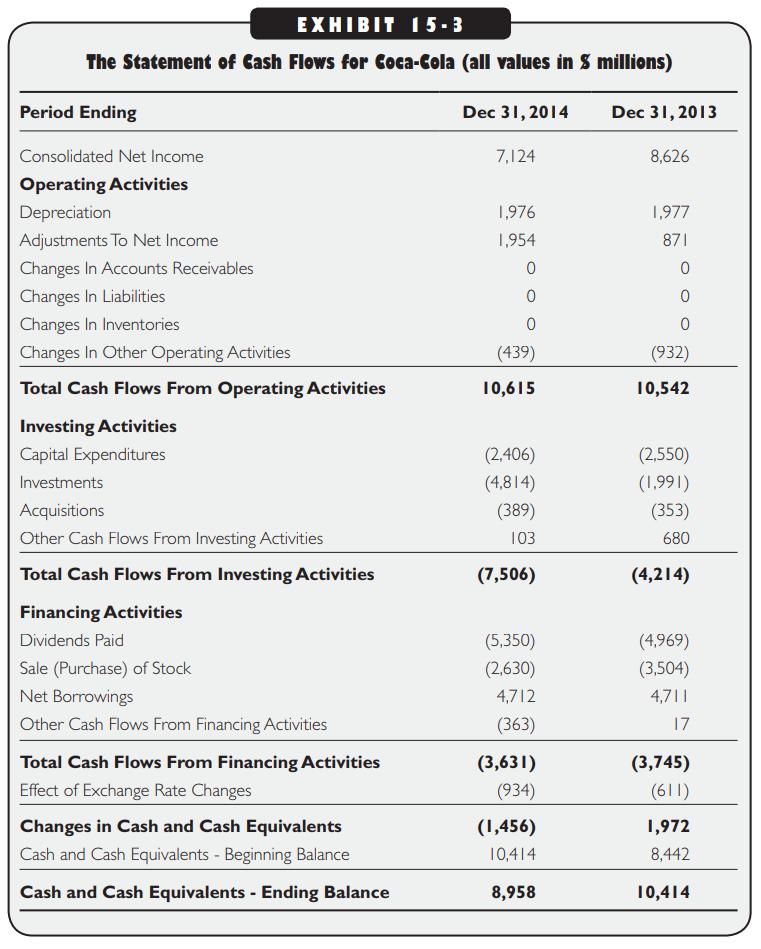

Using data from Exhibits 15‐2 and 15‐3, the FCFF and FCFE for Coca‐Cola for 2014 are as follows (all $ values in billions):

FCFF is generally greater than FCFE; however, in this case, the low interest rate environment encouraged Coke to issue large amounts of debt, which caused FCFE to far exceed FCFF.

Exhibits 15‐2

Exhibits 15‐3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen

Question Posted: