You are trying to decide whether to buy Banguards Large Stock Equity Fund and/or its Treasury Bond

Question:

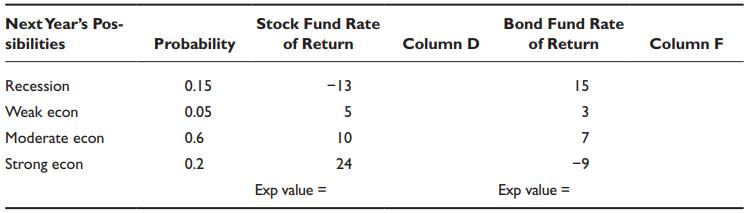

You are trying to decide whether to buy Banguard’s Large Stock Equity Fund and/or its Treasury Bond Fund. You believe that next year involves several possible scenarios to which you have assigned probabilities. You have also estimated expected returns for each of the two funds for each scenario. Your spreadsheet looks like the following.

a. Fill in columns D and F and calculate the expected return for each fund.

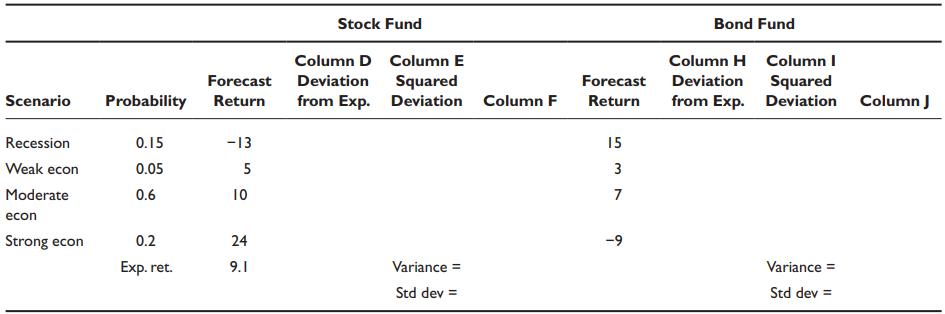

b. Given the expected value for each fund for next year, fill out the following spreadsheet to calculate the standard deviation of each fund. Note that you need to fill in columns D, E, and F for the stock fund and columns H, I, and J for the bond fund. The first two columns in each set are labeled; you need to determine what goes in columns F and J, respectively, which will lead to the variance, and then the standard deviation.

c.

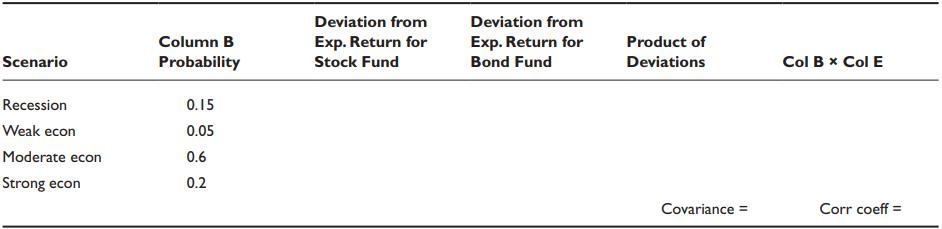

d. Now calculate the covariance between the two funds and the correlation coefficient, using the following format.

d. Now calculate the covariance between the two funds and the correlation coefficient, using the following format.

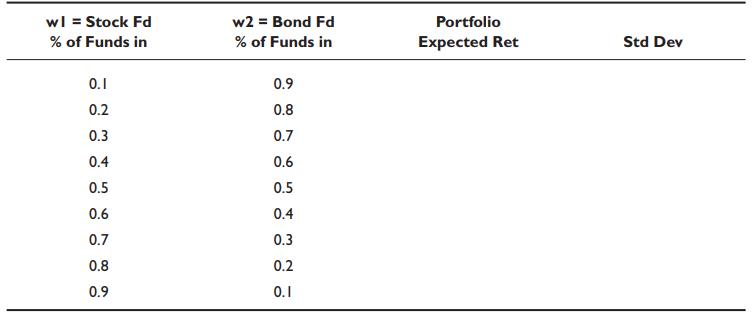

e. Using the formulas for the expected return and risk of a portfolio, calculate these values for each of the following portfolio weights.

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen